I know you’ve been searching for a strategy—maybe the best forex trading strategies—that can help you win in the forex market. Countless times, you have tried different strategies, but you still end up losing, and you are on the verge of giving up.

Don’t be left out, Learn how to trade forex the right way, Click here to get started

In this article, I am going to share the best forex trading strategies in 2024 and tips for consistent profit. If you follow the steps outline in this article, you will add more value to your trading journey.

Here are the main talking point of this article:

- What are Forex trading Strategies?

- How to Develop a Forex trading strategy that works

- How to Choose the best forex trading strategy and tips for consistent profit

Table of Contents

What are Forex Trading Strategies?

To understand how you can win in the market, it is important to understand the meaning of forex trading strategy. The forex market is just like the real-world market, where we bargain and exchange our money for either goods or services. No one goes to the market without a list of items to buy and the projected prices. If you go to the market without a list in mind, you may end up buying what you don’t need and spending so much in the market. So people who win in the real world market must have a list (either written or in their minds), know the projected price, and be ready to bargain when they get to the market.

Forex trading strategies are a set of rules that cover the asset you want to buy or sell, conditions that can influence your buying or selling decision, the amount you are willing to lose per trade, and your projected daily profit.

How to Develop a Forex trading strategy that works

Having understood the meaning of forex trading strategy, how do you develop a forex trading strategy that works? First, you need to understand that the forex journey is 30% strategy and 70% psychology, which means your emotions, impulses and experience will play a big part in your forex journey.

For instance, you need patience for the setup you outline in your strategy to play out before jumping into the market, you also need patience to allow your trade to hit either your stop loss or take profit based on your analysis.

When developing your strategy, consider your emotions because it is your emotions that will determine how far you can go in the market. I have engage with traders who close their trade abruptly in red, only to regrets hours later because their strategy plays out.

Before thinking of developing a winning forex strategy, you have to do analysis of your emotional intelligence, and work on your risk tolerance level. If you cannot take control of your emotions, no matter h0w beautiful your strategy may look on paper, it will be impossible for you to succeed in the market.

The Best Forex Trading Strategies in 2023

1. Support and Resistance Trading Strategy

Support and resistance strategy is one of the most reliable concepts in trading. This is because it serves as reversible and continuation zones for price movement.

In a bullish move, resistance is a point where the price gets rejected, while support is where the price reaches a bounce for continuation. Conversely, in a bearish move, a resistance is where the price gets a bounce for continuation, while a support is where the price gets rejected. Thus, understanding these zones makes trading the support and resistance strategy simple.

FIGURE 1: SHOWING DIFFERENT DOWNTREND SUPPORT AND RESISTANCE ZONES

FIGURE 2: SHOWING UPTREND SUPPORT AND RESISTANCE ZONES

Some support and resistance tools are trendlines, horizontal lines, square shapes, moving averages, Bollinger bands, Ichiomoku Kinko Hyo, etc.

Usually, support and resistance are of different types. For example, there is weak, strong, and very strong support. Conversely, there is weak resistance, strong resistance and extreme resistance. These are determined by the time frame of analysis and the number of times the price gets bounced off and rejected from these zones.

Once the price gets to these zones, it is expected that reactions such as either a bounce or rejection will take place. For instance, in a support zone, prices are expected to buy from that zone. Also, in a resistance zone, prices are expected to sell from that zone.

Pros:

- Less research time is needed; you just need to draw out the support and resistance level, map out your point of interest zone and wait for price to get there before taking any action.

Cons:

- It is subjective in nature, meaning what trader A sees as a strong support may be a weak support to trader be

2. The Break and Retest Trading Strategy

The break and retest strategy is one of my most used forex trading strategies. This is because it gives me a higher probability of trade opportunities and an excellent risk-to-reward ratio.

Break and retest is a strategy both price action and indicator-based traders use. It is helpful as it usually signals a change in trend or the end of a pullback.

Depending on the type of trader, many tools can be used for the break and retest strategy. For instance, the trendline, a horizontal line, a moving average, etcetera are the most common tools used for a break and retest.

To trade a break and retest strategy successfully, the most essential concept to understand is the dynamic nature of support and resistance. Once this is understood, it is easy to maneuver the processes.

The Break and retest strategy start from a consolidation zone, break the zone, retest back at the zone before continuing on the trend direction. A break-out normally signifies that either the bears (sellers) or the bulls (buyers) has won depending on the direction of the trend.

This strategy normally works in a consolidating market – where the asset is going through a series of consolidation; within a channel – where there are continuous support and resistance levels; and in a wedge where the support and resistance levels are going in the same direction.

Pros:

- With a little research and practice, Break and retest zones are very easy to spot out.

Cons:

- Fake break-out normally occurs in most pairs, for beginners traders this strategy needs a lot of practice for them to understand how to differentiate between fake and real break-out

3. Fibonacci Trading Strategy

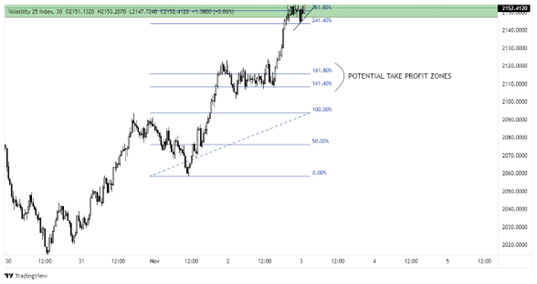

The Fibonacci strategy is one of the oldest strategies traders use in forecasting potential pullback zones and future take profit levels; this is because of the Fib tool comprises the Fib retracement and extension levels.

To trade the Fib strategy, a trader needs to understand how pullbacks work and how to maximize it for future price levels. To trade pullback levels, the retracement price levels are used in extrapolating potential premium (above 50%) and discount levels (below 50%) within the trend.

Here are Tips for Consistent Profit in the forex market

- Develop a profitable mindset

Developing a positive mindset is a trigger which fuels a winning attitude. If every trader understands that forex trading is designed as a career, just like every other occupation, it will change how you see trading. That means that in the same way medicine settles the life of a trained doctor, forex trading presents opportunities for traders to provide for their lives. What this means is that the money in forex trading is for you.

You are to go in there, use your skills and get as much as possible. Like no career was designed to make failures, forex was not intended to make you a failure. At the other end, to succeed, you need to lend time and learn to the point of mastery. Developing this type of mindset will change every wrong notion about forex trading. It will make you treat forex trading as a good adventure designed for your profit. It will also help you pay the required price for a successful trader.

A positive mind is very important because of fear. Most often, it has been noticed that more than 75% of losing trades are traced to fear of failing. This implies that after many traders take trades, they feel like it will end in red. This type of fear sponsors poor trading decisions, such as trading on impulse (trading without proper chart analysis) or closing open positions prematurely. To overcome fear, a positive mindset is needed since a positive mind is a breeding ground for success.

- Be patient

Patience is a virtue. I learned this from my mentor. Never be in a haste to take trades. Take time to analyze the market. This is because trading is 70% analysis, 10% execution, 10% ability to hold winning positions and 10% ability to close losing positions. So, if you want to be or maintain consistency in profit-making, develop patience. Patience will help you to know if your analysis is correct or wrong. Also, it will teach you to create an enduring attitude, especially when trades are in blues.

- Avoid taking trades on impulse

Impulse trading means jumping in and out of trading without proper analysis. This may be caused by fear of missing out, pressures to meet daily needs, and overconfidence. Any trade taken on impulse rarely ends well. Like my mentor will say, when you jump into the market, the market will make you jump out. So, to be consistently profitable, take time to analyse your charts and be patient for them to play out.

- Learn to maximize trading opportunities

Knowing how to close losing positions early is a great skill. Conversely, learning to add to a winning position is another skill every trader must master. This is because, without these two skills, profiting consistently will be slow. Hence, to have a fast rate, every trader should learn to add to winning positions and hold them for days (if necessary) while he/she closes losing positions early.

- Keep a track of your trading history

Keeping track of your trading history is a meaningful way to assess yourself. It will help you know the market that seems more profitable and the specific trading style that suits you better. Above all, a trading history allows you to recognize previous price patterns that repeat themselves. To have a good trading history a trading journal is always the best way to document a trading history. Hence, seek ways to get a trading journal to get this settled.

If this publication has been helpful to you and you desire to know more about what to takes to be successful in trading, kindly do the following.

- Signup on my YouTube channel at https://www.youtube.com/c/juvirtrades

- Sign up for my mentorship through juvirtrades@gmail.com.

- Join my free WhatsApp group https://chat.whatsapp.com/HJ2Lz96W378BJVfsQ5nU2F

- Contact me through a direct call on +2348027790183.

This article was reviewed by Warren Ventekas

Risk Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.