Deriv is one of the most successful forex brokers with many tradable assets grouped into financial assets and the Synthetic Indices assets. Financial assets offered by Deriv includes Forex Major, Forex Minor, Forex Micro, Metals, Stock Indices, Cryptocurrencies, Energies, Equities (US and Europe), Exchange-Traded Funds (ETFs) and Conversions. Synthetic Indices assets offered includes Boom and Crash Indices, Volatility (Is) Indices, Basket Indices, DEX Indices, Jump Indices, Step Index, Range Break and Derived Indices.

Don’t be left out, Learn how to trade forex the right way, Click here to get started

Basket Indices is one of the newly introduced tradable asset which was developed by Deriv in 2022 and grouped under the financial markets contracts for difference (CFD). This is because, Currency Basket exhibits the characteristics of the foreign exchange (FOREX) markets such as a 24-hour trading with open and closing market period between Sundays 9:30pm to Fridays 9:30pm, a minimum applicable (micro lot size) as well as tendency to experience high volatility and price fluctuations during fundamental interceptions.

Few weeks after its introduction, Basket Indices was moved from a financial asset into the synthetic Indices category. There, it became one of the traded assets alongside other Synthetic Indices assets. The transition was done primarily to add to the number of assets traded under the Synthetic Indices contracts for difference (CFD). Although no notable changes have been made to any of the Basket Indices assets, it has been observed that unlike Synthetic Indices assets, Basket Indices does not trade on weekends.

Table of Contents

What is Basket Indices?

This is a type of financial asset which has a base currency and a set of other currencies. Using financial analogy, a basket index comprises a base currency and a portfolio of other multiple currencies in which it trades against. Primarily, currencies used for trading basket indices are major forex pairs that is subjected to different percentage weight.

In the case of Deriv’s basket indices, each of the currencies in the basket is weighted at 20% against the base currency. This is aimed at giving an equal probability chance for detection of changes in price fluctuations for each of the basket currencies.

For instance, the USD basket comprises the USD as the base currency and EUR, GBP, JPY, CAD and AUD as basket currencies. If a trader decides to buy the base currency (USD) against the basket currencies, and price goes bullish, the implication is that while the base currency appreciates, the value of the basket currencies will depreciate (in risk and volatility implications). Conversely, if the reverse was the case, the equal weight for all of the currencies will cause the price to hedge itself through ranging.

What is traded in Basket Indices?

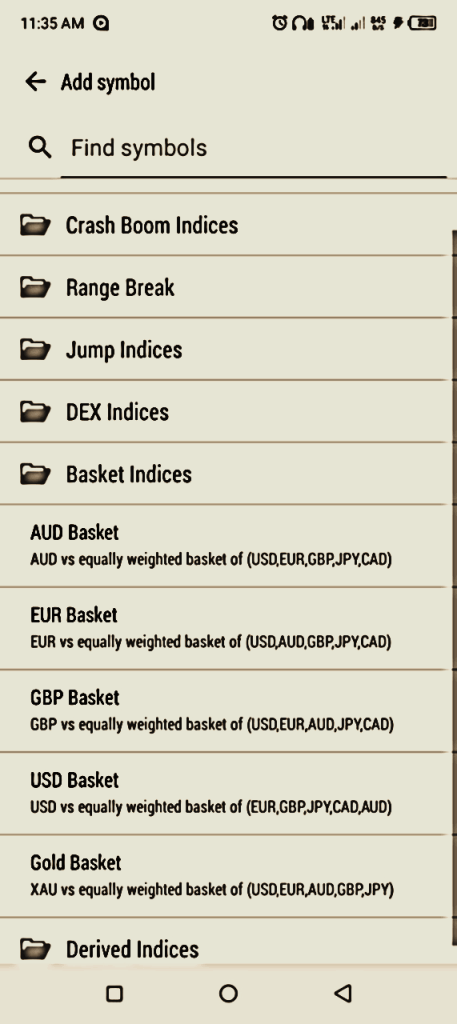

The derived basket indices comprise assets such as the Australian Dollar Basket, the United States Dollar Basket, the Euro Basket, the Great British Pounds Basket and the Gold Basket.

Picture 1: Showing the assets traded in Basket Indices

The AUD basket comprises AUD as the base currency and USD, EUR, GBP, JPY and CAD as the basket currencies etcetera. The USD basket comprises USD as the base currency while EUR, GBP, JPY AUD, and CAD are the basket currencies. The EUR basket comprises EUR as the base currency while USD, GBP, JPY AUD, and CAD are the base currencies. The GBP basket comprises GBP as the base currency while USD, EUR, JPY AUD, and CAD are the basket currencies.

Usually, the Gold Basket is always categorized into commodity Basket but, Deriv.com choses to leverage on financial regulations and categorize the asset to be within the Synthetic Indices. For that reason, the GOLD basket comprises Gold as the base currency and USD, EUR, GBP, JPY and AUD as the basket currency. This, is done most likely to suit her modus operandi especially when considering the financial regulation of each other nations the company operates.

Why is this Indices Important?

Basket indices was developed as one of the financial instruments for the purpose of diversification and expansion. Also, the market is designed to ensure reduced risk and volatility of the base currency when traded against the currencies in the basket. This is also aimed at promoting a low degree of currency exchange rates as well as ensuring hedging when a trader’s technical analysis bias or forecast does not play out. Since all the currencies used in trading the Basket Indices are major forex assets, such can also be useful in creating stability by using the 10% equal weight of the currencies to access macroeconomic indices such as trade balance, ease of foreign exchange and terms of trade between countries

Strategies and Tips for Success

Understand Price Action

Just like the forex market, the Basket Indices obeys price action. (You can read a comprehensive guide on Price Action by Clicking here). Start by understanding the major support and resistance, then monitor price action reactions at those point.

If you look at the chart above, you will see Point 1, Point 2, point 3 and Point 4. The four points are areas of strong price reaction. The market is currently at Point 2, it will retrace for about 20 minutes or more before making any decision (either to sell down or go up). Your first tasks as a trader is to look for these points in your chart, and mark them down as your Point of Interest (POI), then wait for price action to get to those point before taking any trading decision. Trading this way will give you up to 90% probability of winning all your trades.

Know how to Manage risk

One of the major challenge most traders face that is affecting their profitability in trading is their inability to manage risk. Risk management is important if you want to make money in trading and build a sustainable income from it. To get ahead, treat your trading as an investment, allocate both resources and time to ensure that you achieve your investment objectives – which is sustainable profit, not just one win, then plenty loses. To achieve this;

- Have a trading plan that include your lot size and daily profit target and stick with it.

- Don’t trade without a Stop Loss and a Take Profit level

- Only take a trade once all the conditions you laid out in your trading plans are met.

- Make the Chart your friend; that is, study, analyze, wait and monitor before placing any trade.

If this publication has been helpful to you and you desire to know more about what to takes to be successful in trading, kindly :

Subscribe to my YouTube channel at https://www.youtube.com/c/juvirtrades

Or Sign up for a one-on-one mentorship training via juvirtrades@gmail.com.

You can Open a free demo/real account under the Deriv.com

Contact me through a direct call on +2348027790183

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.