FirstAdvance is a product of First Bank, in this article we are going to take you through all your need to know about FirstAdvance, loan application, repayment process, etc.,

Table of Contents

What is FirstAdvance?

FirstAdvance is a quick lending remedy offered by First Bank (one of Nigeria’s astute financial institutions) to salary earners to enable them conveniently satisfy their growing daily needs until their payday arrives.

Benefits

- Accessing FirstAdvance is fast and easy. The entire application process is done online after requirements have been met. This implies that one can engage in the process anywhere and anytime.

- After your application is successful, the approved amount is usually credited within minutes to the user’s account allowing them to meet their urgent needs on time.

- You can borrow a maximum amount of 500,000 naira, with no guarantor or paperwork required and pay back when their earnings are received.

However, FirstAdvance is subject to certain requirements and for one to apply for a loan, the individual must meet the required criteria.

Requirements

Below are the requirements ;

- Applicant must be a salary earner.

- He or she must be a First bank customer or must be willing to move their salary account to First bank.

- The applicant’s bank account must hold proof of receiving a regular salary for at least 6 months or more.

- The loan amount an applicant applies for must be linked to the monthly salary amount he or she receives.

- It requires one to pay an upfront payment of all its charges( management, VAT, insurance and interest rate) immediately after the loan has been approved and disbursed.

- All loan applicants must complete the application form and accept its terms and conditions.

How to apply for a FirstAdvance Loan

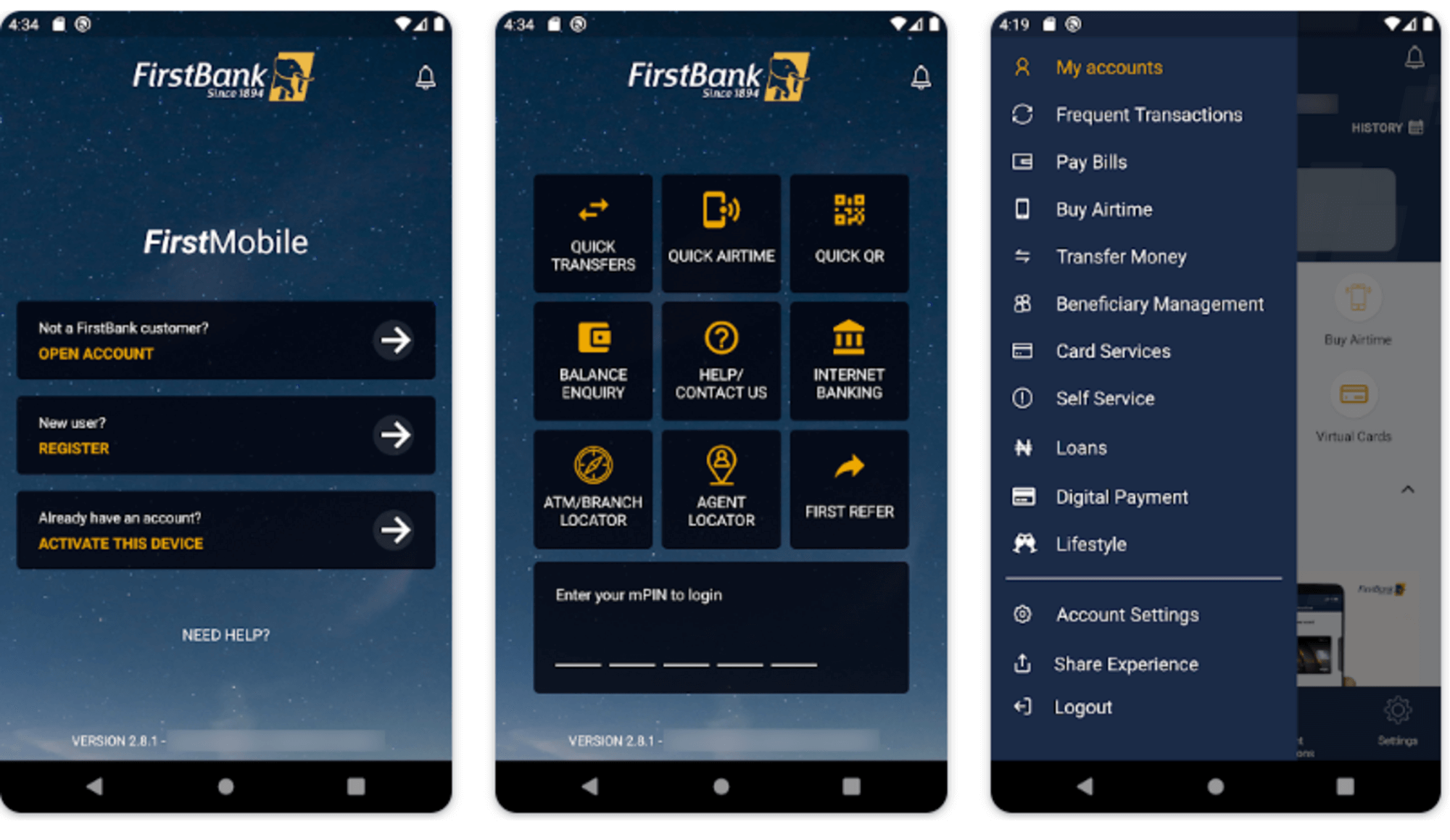

- You can apply for a loan through the FirstMobile app or the First Bank USSD code(*894#).

- To apply for a loan, download the FirstMobile app from your smartphone’s play store or log in if installed already on your mobile device.

- Navigate to the “menu” options located on the top left of your First Mobile app and select “Loans”.

- You will be presented with a dropdown menu of loan options, choose” FirstAdvance”

- On the page, you will be shown your eligible loan amount(if found eligible) and the fees associated with your eligible loan amount.

- Proceed to accept the terms and conditions and input your desired loan amount which should not be more than the amount you are eligible to apply.

- Enter your bank account transaction pin after.

- If your loan application has been approved, you will be credited with the approved amount within minutes also your bank account will be debited with your loan associated fees.

- After 30 days or on your stated payday, Firstbank will automatically debit your account of your given loan amount.

- The same process applies to the USSD code option. The only difference is you will have to use FirstBank USSD’s code(*894#) and select the “Get loan ” option( number 3) to apply.

Interest rates, Repayment tenure and Associated fees

- FirstAdvance charges a 2.5% interest rate for every loan amount applied. The interest rate is dependent on the loan amount applied for.

- They also charges a 1.0% management fee, an insurance fee of 0.59% and a VAT(Value Added Tax) fee of 7.5%. The VAT Fee is charged from the management fees.

- In instances of late payment, they will charge an overdue fee of 1% of the amount due until the given loan is repaid in full.

- The repayment tenure is usually 30 days or your salary payday.

How to Repay FirstAdvance Loans

They has a flexible loan repayment feature. To repay your e loan, you can pay directly through your First bank account or any bank account from a recognised financial institution.

My Firstbank monies App is not functioning again to be used to collect First bank advance loan. What can I do to help me please.