One temptation most new traders face in Boom and Crash is trying to trade the tick candles instead of the spikes. Trading the tick candles may makes you to see quick profit, but it is very risky if you enter a trade at a wrong spot, one spike can wipe out your entire profit. So in this article, I am going to share my secret to buying crash and selling Boom.

Don’t be left out, Learn how to trade forex the right way, Click here to get started

Table of Contents

The Secret to Buying Crash and Selling Boom

Before delving into the secret to buying crash and selling boom, let’s look at one fundamental question. This question is very vital, because the answer shall provide the foundation on which our short tutorial will be based.

Is it possible to trade against the Spikes in Boom and Crash and be profitable?

To be frank, the answer is yes and no. Yes, in the sense that, with the right strategy and mindset, you can make good profit from trading against the spikes. No, in the sense that, if you are just trading it because you see profit immediately without any strategy, you will blow your account in no time.

‘It is tempting to trade the tick candles, but the spikes are more profitable’

Having said that, so how can you buy Crash and Sell Boom successfully?

Don’t be left out, Open a free trading account now by clicking here

The only secret to buying Crash and Selling Boom is waiting for your setup to play out. That is where Fear Of Missing Out (FOMO) comes in. Let’s say you have analyze your trade and you have spotted your Point of Interest (POI), your next task should be waiting for the trade to get to your POI, then see the price reaction at that point before taking a decision. Most traders don’t wait for the price to get to their POI, they just jump in to be part of the ride without understanding what is going on in the market.

Waiting for your trading setup to play out before taking a trading decision is very vital when you are trading against the spikes. It is not enough to analyze, if you analyze without waiting for the price to get to your POI, you may not be profitable.

If you don’t know how to analyze the market, here are some steps to get you started:

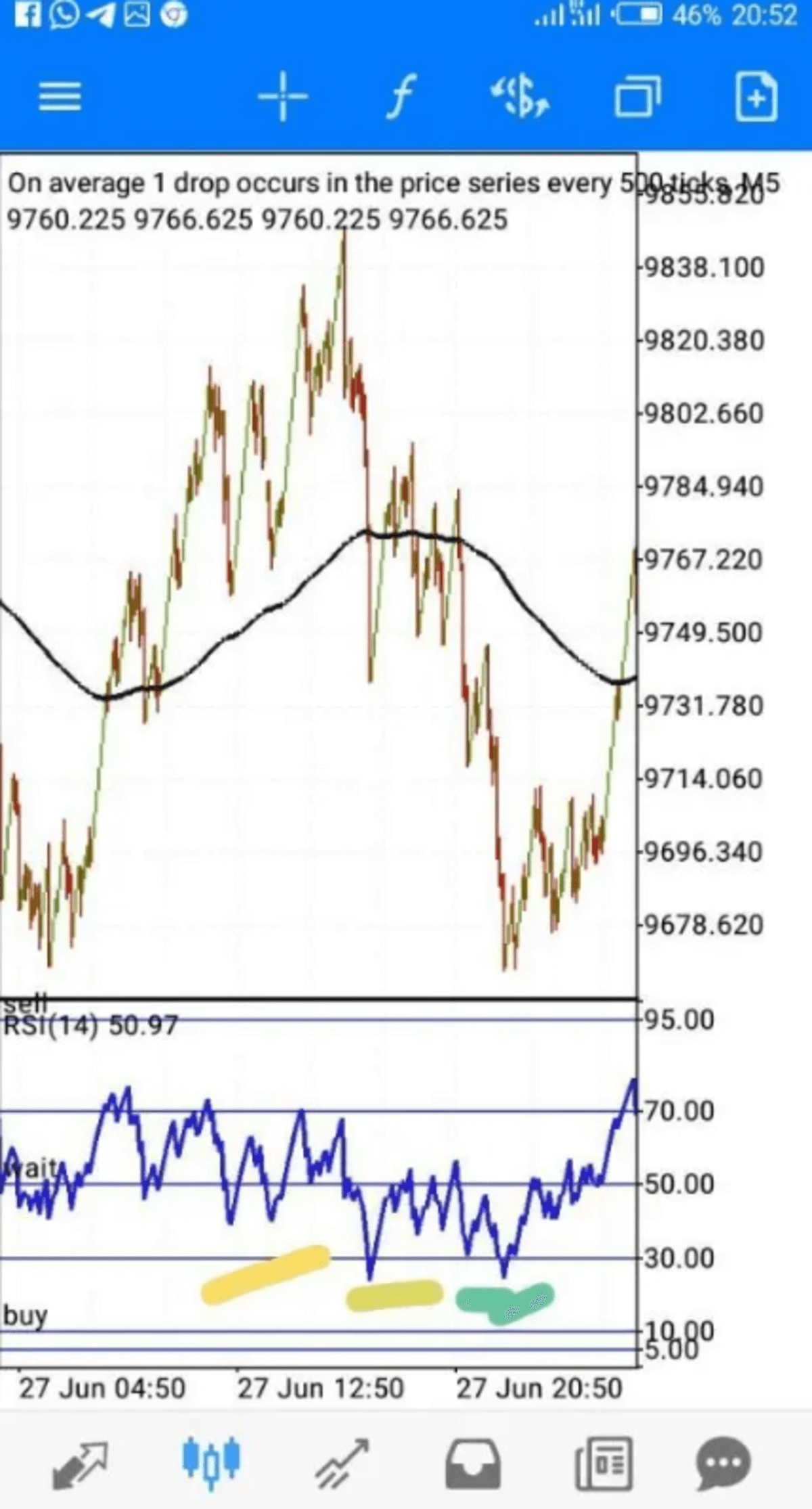

Step 1: Go to the higher timeframe to know the trend

The Trend is your friend, your first task as a trader is to determine the trend of the market from the higher timeframe.

Step 2: Mark out your Point of Interest (POI).

Now that you understand where the market is going, it’s time to mark out your POI on the chart. Your POI is area of market reactions, it can be more than 3. Look at the chart and see where there was previous retracement, strong buying pressure, etc.,

Step 3: Wait for trades to Reach your POI

As I said earlier, waiting is always very hard. But it’s a good trading decision to monitor and enter trades only at your POI. So wait for the price to get to your POI before taking any trading decision

Step 4: Once price get to your POI, go to lower timeframe and look for entry based on market reactions at your POI.

Once price get to your POI, monitor price reaction at that point before taking any trading decision. It’s better to have at least a 90% probability of winning a trade, than to just jump in without looking at previous market history

Step 5: Remember to Put Stop Loss and Take Profit

Don’t place any trade without any Stop Loss. A stop loss is a good cushion that can protect your trading capital.

On a final note, trading Boom and Crash is easy, you need a little patience and consistency. .

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.