As a synthetic index trader, you may be having trouble understanding boom and crash. In this article, we delve deep into how to trade Crash 500 successfully.

Don’t be left out, Learn how to trade forex the right way, Click here to get started

Table of Contents

How to trade Crash 500 successfully

What is the Crash 500 index?

As a financial market enthusiast, you must have heard of boom 500, boom 1000, crash 500, and Crash 1000. Boom and crash are known as synthetic indexes. Synthetic indices are simulations of the real market.

Don’t be left out, Open a free trading account now by clicking here

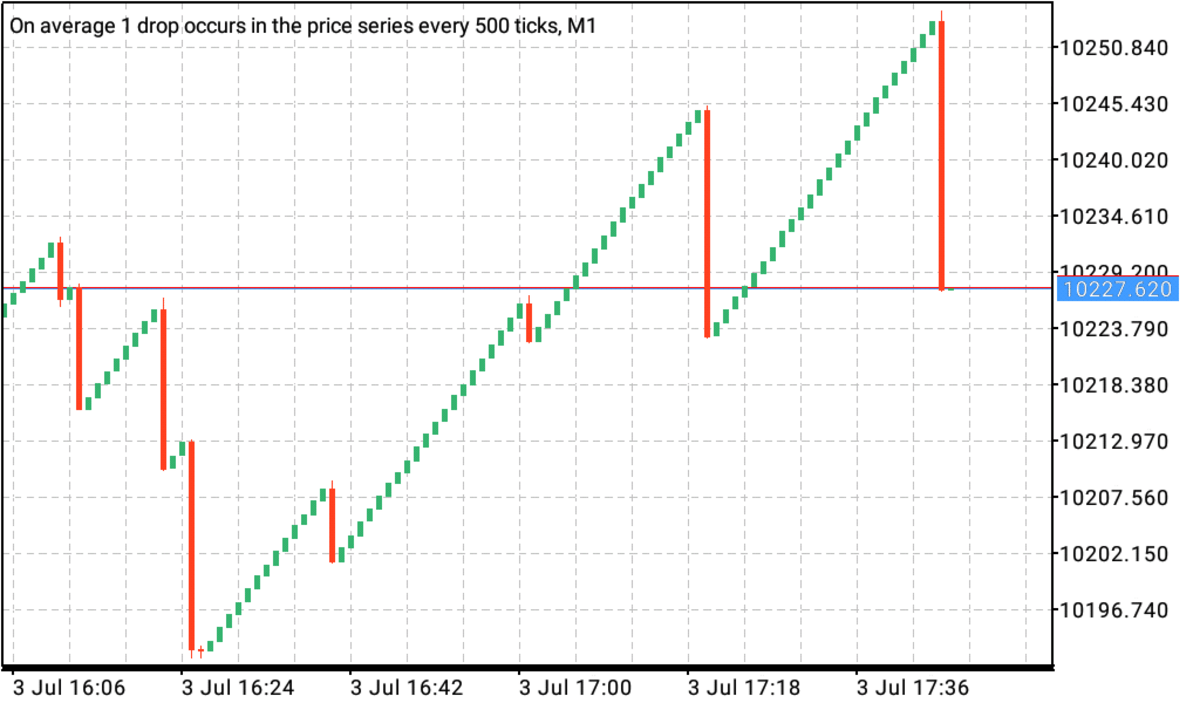

With crash 500, there is an average drop in price that occurs at any time within 500 ticks. Crash 500 presents itself as many bullish candlesticks with an occasional bearish candlestick. The bearish candlestick can engulf 6 or more small bullish candlesticks.

A lot of traders have a hard time understanding how to trade Crash 500 successfully. Before getting into a Crash 500 trade, it is very important to understand charts formations to see the market trend and spot areas of support and resistance. There are various tools of technical analysis already installed in MT5 that can assist you in this, off course, you also need a good understanding of price action.

When trading crash 500, the price is stronger in the selling zone (price ceiling). The Crash 500 market buys by default. However, when crash 500 sells (crash), it sells with long bearish spikes. This characteristic makes synthetic indexes seem like a scary adventure for beginners. Because, you may wish to take just a few candlestick buy on Crash, but after few move the price crash putting your positions on red.

Figure 1: Crash 500 chart showing a bearish spike

Figure 2: Crash 500 chart showing the default bullish buy candles

Strategies used to trade crash 500 successfully

Just like any other form of trading, Crash 500 requires strategy. Some strategies used by traders include scaling, day trading, swing trading, and position trading. Before settling in a specific strategy, you need get to know your trading style, trading psychology, exposure, and experience. Learn your personality and gain trading knowledge.

Learn the Secret of Forex Trading, Click here to download a free e-book now

-

Scalping

Most crash and boom traders begin as scalpers. The way the boom and crash market is structured, scalping seems like a great strategy. This is due to the spikes that occur in both boom and crash.

Understanding Price action and the use of technical analysis tools can help boom and crash traders in scalping: Some of the frequently use indicators includes: Relative strength index, MACD, moving averages, Fibonacci lines, stochastic Oscillator, Average Directional Index, Bollinger Bands, etc., A combination of these tools helps traders make decisions on how to enter trades.

Let’s take you through how to trade Crash 500 successfully in a 2-minute scalping strategy.

For this strategy, you will need to use two indicators: the relative strength index (RSI) period 14 level 10, 50 and 85 and Alligator (13, 8,8,5,5, 3)

Condition for a buy.

Please pay attention to this instruction, It is important that you follow it to the later and modify the strategy as you discover new things from the market.

1. To use this scalping strategy, you have to know the trend of the market, if it’s on a sell trend, don’t buy, just look for spike opportunities only. But if it an uptrend, wait for the conditions below before buying.

2. Before we continue, add 200 EMA to your main chart; once price action is below the 200 EMA, price is on a sell train, when price action is on a buy trend

3. Enter a buy, once all the alligator line cross RSI level 10. Start with small lot first, then gradually progress from then

4. Use M1 or M5 to scalp. Don’t forget to check your risk-reward ratio. Learn about the scalping strategy for a small account on boom and crash.

2. Day trading or swing trading

Trading is a skill that is perfected through experience. You can’t remain a scalper trader forever. In fact, the best way to successfully trade Crash 500 is day trading. Start by using technical analysis tools (e.g., RSI period 14 -level 10 and 80 or Stochastic (1,1,1) level 20 and 80) to understand the trend of the market; Identify key support and resistance levels.

Day trading involves the use of higher timeframe in analysis and also in trading. Once you spot the key levels, you can either buy or sell using a limit order or you can wait for the price action to touch the RSI 10 level or Stochastic 20 level for a buy or RSI 80 level and Stochastic 80 level for a sell.

Figure 5: Crash 500 chart showing price action chart

Here are 7 tips to consider when trading crash 500

- Risk Management is key; know when to open and when to close a trade order

- Map your chart. Trading is not a form of guesswork; before trading, make sure you analyze the charts and see the bigger picture. Get to know the support and resistance levels, demand and supply zones, utilize indicators and analyze different patterns and trends in different time zones.

- Don’t just wait for spikes. Synthetic indexes also follow a technical pattern and adhere to the rules of price action. Try to get into day trading or swing trading to make longer positions which can make earn up to 200 pips.

- Know when to go all out in the market. The best thing about trading synthetic indices is that spikes can be predicted with more accuracy. Factors that can help you predict effectively include support and resistance levels, demand and supply zones, simple exponential moving average, and others. Spike traders have the advantage of using bigger lot sizes and tight stop-loss when they are quite sure of their prediction.

- Take a break from boom and crash indexes. After your first loss or profit, it might be tempting to continue trading to recover the loss or get more money. Professional traders have especially warned about staying in the market after making several losses.

Trading crash 500 needs careful market analysis and preparation. It might seem easy to just enter a buy trades, but if you enter at a wrong place and the spikes comes, it can but that deplete your account.

Get more insights on how to trade spikes on boom and crash here!

N/B: This article is based on my experience in the market, please apply proper risk management, It is important that you test the strategy on your demo first, make some modifications before trading with your real account.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

May i have this text in french