Scalping is a day trading style that focuses on taking profits off small price movements. Scalpers concentrate on making high trade volumes with small profits. Scalping is ideal for beginner traders who can benefit from making such small trades repeatedly during a trading session. Scalping is more popular because the market is continuously making small price movements as compared to large ones. A scalper needs to be attentive to the charts, waiting for a chance to open a trade.

Learn the Secret of Forex Trading, Click here to download a free e-book now

This trading strategy uses both the moving average and Stochastic Oscillator to get the right opening positions. The basic reasoning behind using this strategy is that the cause of a spike or drop in boom and crash is a reaction to price hot zones such as support and resistance. Boom and crash heavily rely on price action movement therefore technical analysis is very crucial. The first indicator you need for this strategy is the stochastic oscillator.

Table of Contents

Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator and it compares the market’s closing prices to its price range covering a particular period of time. The Stochastic Oscillator ranges from 0 to 100. When the indicator is reading at 80-100 it shows that the market is overbought and when trading at 20-0 it shows the market is oversold. The Stochastic Oscillator appears below the chart. When the oscillator goes below 20 (oversold region) the buyers try to reverse the trend therefore, it is a signal to buy. Alternatively, if the oscillator is above 80, sellers become aggressive therefore, it is a signal to sell. Remember that the trend is always your friend; follow the trend.

Moving average

Moving average is a technical analysis tool that maps out price movement by constantly updating the average price. It helps show the market direction without any noise so that the trader can get a general idea of how the market is moving. If the moving average is angled up, then it is an uptrend, while if it is angled downwards, it is a downtrend. The general guide is that if the price is above the moving average, it is an upwards trend while if it is below the moving average the market is trending downwards. The average price is calculated over a particular time such as 20 minutes, 10 days, or at any time the trader wishes.

Moving average is a good indicator of trend direction and support and resistance levels. When the moving average falls over or below the trend, it can be a signal to trade. In a downtrend, the moving average can act as resistance such as when the price is trading below the line. Alternatively, in an uptrend, the line can act as support, when the price is trading over the line.

Moving averages can be useful on their own but when used with other indicators such as the Stochastic Oscillator they form a strong basis to enter a trade.

You can customize the moving average so that the trader can choose whatever time frame they wish. Commonly used timeframes are 15, 20, 30, 50, 100, and 200 days. The longer the period used the less sensitive the average. Therefore, when using scalping shorter time frames should be used to reflect shorter price changes.

If the chosen moving averages cross over one another, this can be a signal that the trend is about to reverse, thereby giving you an opportunity to trade. The trend reversal is confirmed when the first full candle forms in the direction of the trend reversal.

This strategy can only be used during a downtrend for boom and an uptrend for crash

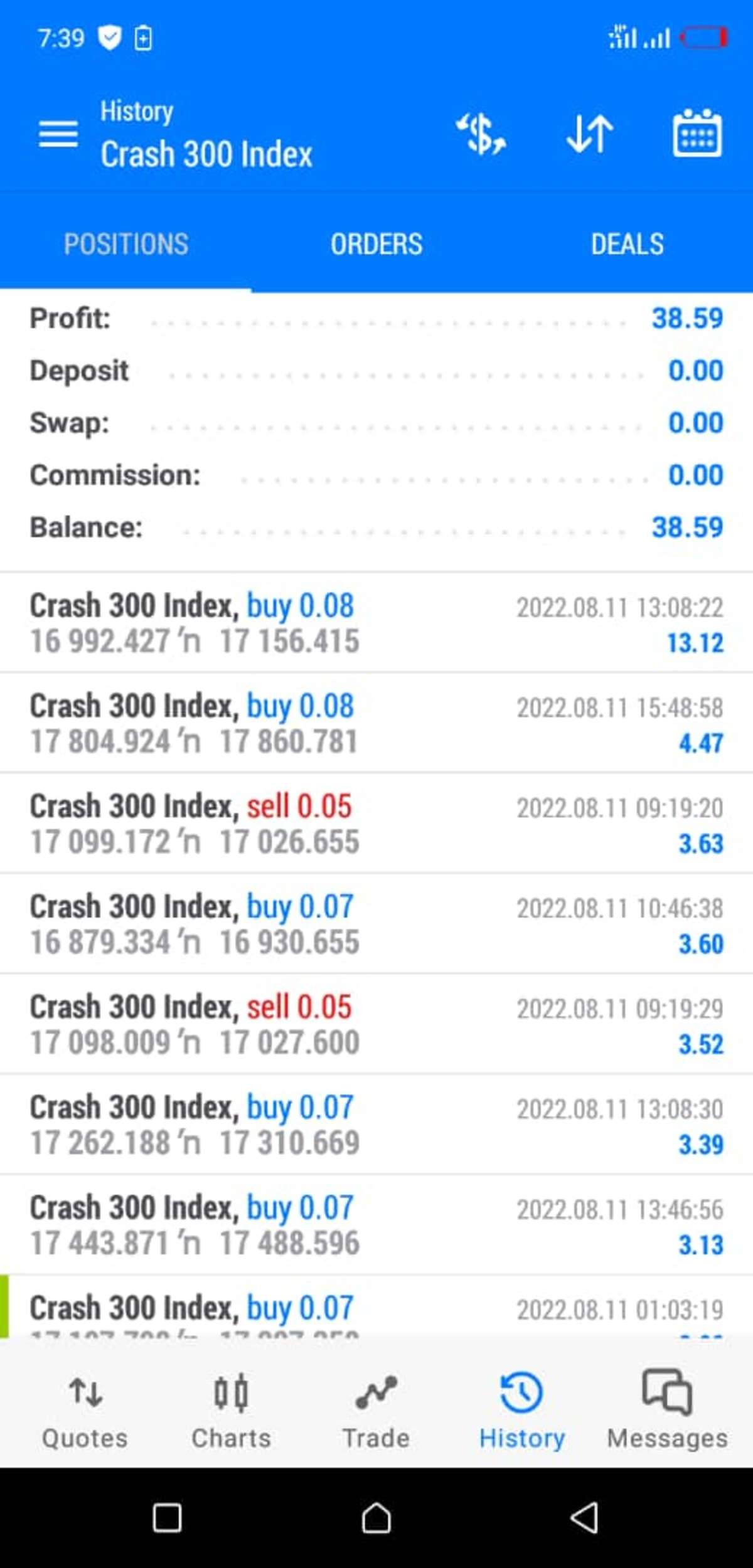

How to flip $10 account to $1000 With 1 minute boom and crash Scalping strategy

1. Ensure that there is a clear trend. For scalpers, confirm the trend from the 4 hour time frame, 1 hour and 30 minutes, and ensure that there’s consistency in market trend.

2. Ensure a spike pushes the market to the overbought region. Use your Stochastic Oscillator; if it goes beyond level 80, then the market is overbought.

4. For a one minute scalping strategy use period 10 simple moving average and period 7 exponential moving averages

5. Ensure the 7-period moving average crosses below the 10-period moving average

6. Ensure a full candle closes below the two moving averages to confirm the downward trend.

7. Count ten candles and take your profit

It is very easy to flip $10 account to $1000 With 1 minute boom and crash Scalping strategy using moving average and the Stochastic Oscillator. As a trader, you need to wait for certain conditions to manifest before rushing into a trade. Additionally, use risk mitigation measures such as take profit and stop loss. The moving averages and Stochastic Oscillator use support and resistance and as well price movement to predict market movement.

All the best in applying this strategy!

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

Hi, thank you for sharing your strategy. Could you, please, post photos of the the oscillator and the moving averages already configured?? I think I’m missing some points.

Hi. How has this been going? Pls Contact me on +2348034644646, I’d like to discuss your experience so far.

what is the zoom level..when using mt5

I dont really understand how to identify the hot zones, can you help?