If you are struggling to make money in the forex market, you have one thing in common with the other 98% of struggling forex trader, which is lack of written down Forex trading plan. In this article, I am going to share with you how to set smart forex trading goals.

Don’t be left out, Open a free trading account now by clicking here

It’s true, when you don’t have a Forex trading plan, you are fueling your emotions to inspire the two most vicious enemy of trading – Fear and greed, these two will cloud your trading decision and inspire how and when you take your trades. Taking your trading decision based on fear or greed is the worst thing that can ever happen to you as a forex trader. So how can you avoid it?

The only way to avoid it, is to set smart forex trading goals and stick to your trading plan no matter the percentage of loses or gain you may encounter during your demo or real trading journey.

If you can’t: 1) Trade a profitable system 2) Manage your emotions. Stop blowing accounts and use that money to invest in yourself. You win with skills, not luck.

Table of Contents

How to Set Smart Forex Trading Goals

Treat Forex as an Investment not as a game of luck

Trading is not a game of luck or gambling that is while you need to set smart forex trading goals and develop a forex trading plan that will guide you in your trading journey. When you are not trading with a forex plan, two scenarios are bound to happen:

Scenario 1:

If you make 2 or 3 quick win in a row, you may want to increase your lot size and stack trades in order to win big.

Scenario 2:

If you lose 2 or 3 trades in a row, you may become so afraid of the market that you won’t even have the confidence to place trade because of fear.

Scenario 1 inspires greed, while scenario 2 inspires fear because you are gambling or depending on luck, you are not looking at Forex as an investment.

Why you need a trading plan

- To guide against your emotion

- You will not place trade just to be in the market, you will place trade based on your trading plan

- You will increase you winning probability by over 90%

- Trading plan will help you to stay motivated to achieve your goals

How does a trading plan look like?

In this section I am going to share with you some guide on how you can come up with smart forex trading goals and develop a trading plan that will inspire your trading journey. But first download a copy of my My first Forex Trading Plan

In the file you downloaded, you will see just two things, my trading goals, how to achieve them and my weaknesses and how to overcome them.

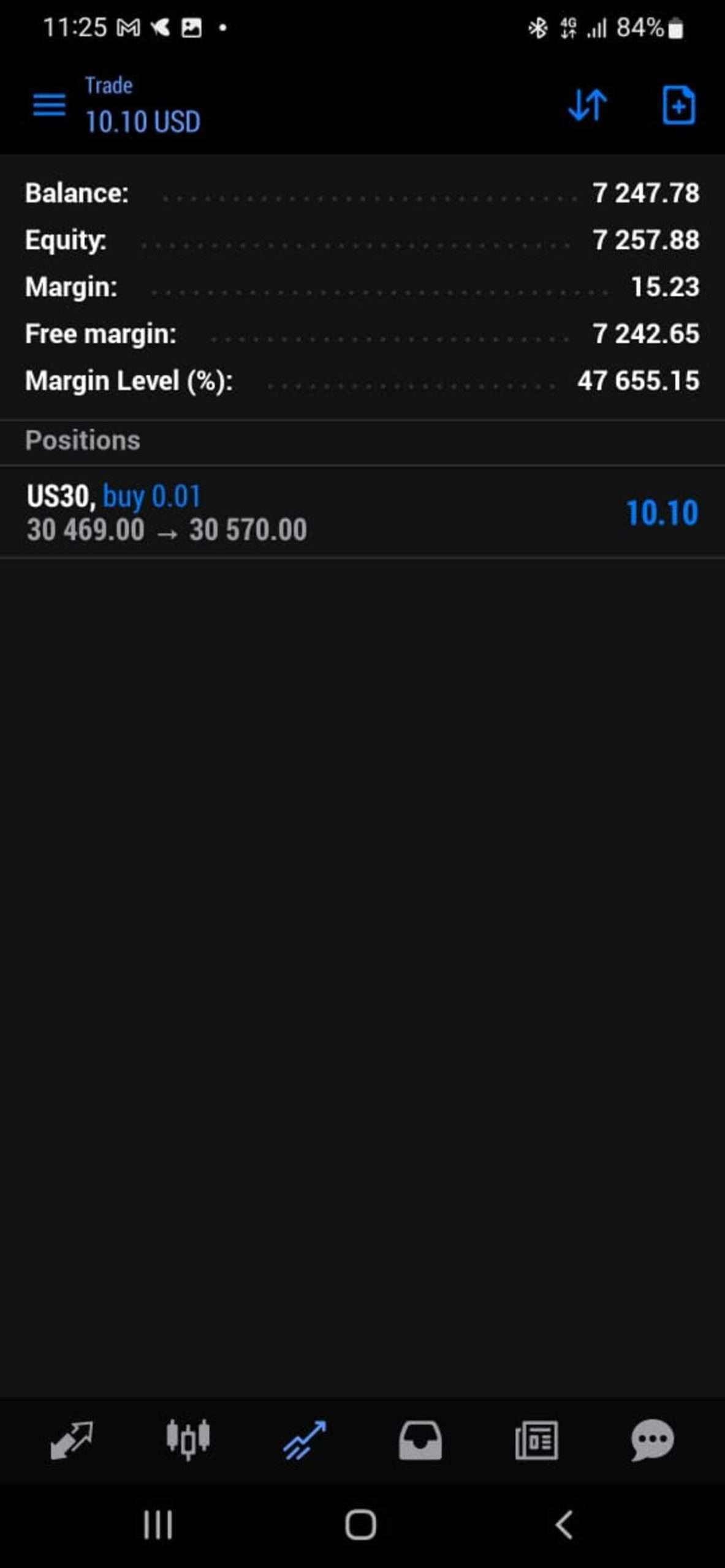

For instance, My goal 1 is : To earn 15% of my trading equity weekly using Price action trading strategies. If you notice, my trading goal is simple and measurable and it has a strategy. Your strategy can de different, but you must have a strategy you are following. Two things are very important in forex, have a strategy and a plan that works.

At the end of week one, I will review my equity to see, If I was able to meet the target goal.

My weakness: When you look at the weakness side in the file you downloaded, you will see the three common weakness that faces all struggling forex trader.

- Greed

- Fear

- And analysis paralysis

Yours can be any other thing beside the one I mentioned above, you need to write it down, then develop means/method that you will use to overcome them.

What is your daily Forex trading routine?

This is a critical part of your trading plan. I didn’t include this in the document you downloaded, but I am going to share what my normal trading routine looks like, so that you can use that to develop or modify your own.

- I check economic calendar when I wake up to understand the pair to avoid (this is mainly for forex currency traders.

- Based on the outcome from the economic calendar, I classify pair to trade and those to watch out for

- Then I mark key zones on the chart and wait for price to get there for me to feast on the market

- I close the day by reviewing my trading history and planning for the next trading day

Set you Trading Strategy

There is already a comprehensive article on Price action trading strategy, the strategy I use on this blog, if you have not read, click here to read it now. You must have a strategy and stick with it. That is while I advice back-testing your strategy and demo trading to find loop-holes before going to your real account. It is very wrong to jump from one strategy to another. The problem may not be the strategy but your trading psychology.

Final Thoughts

Don’t just want to be in the market, be in the market to win in the market by setting smart forex trading goals and developing a trading plan that will have you make money in the forex market. Also keep a trading journey to record your trading journey.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.