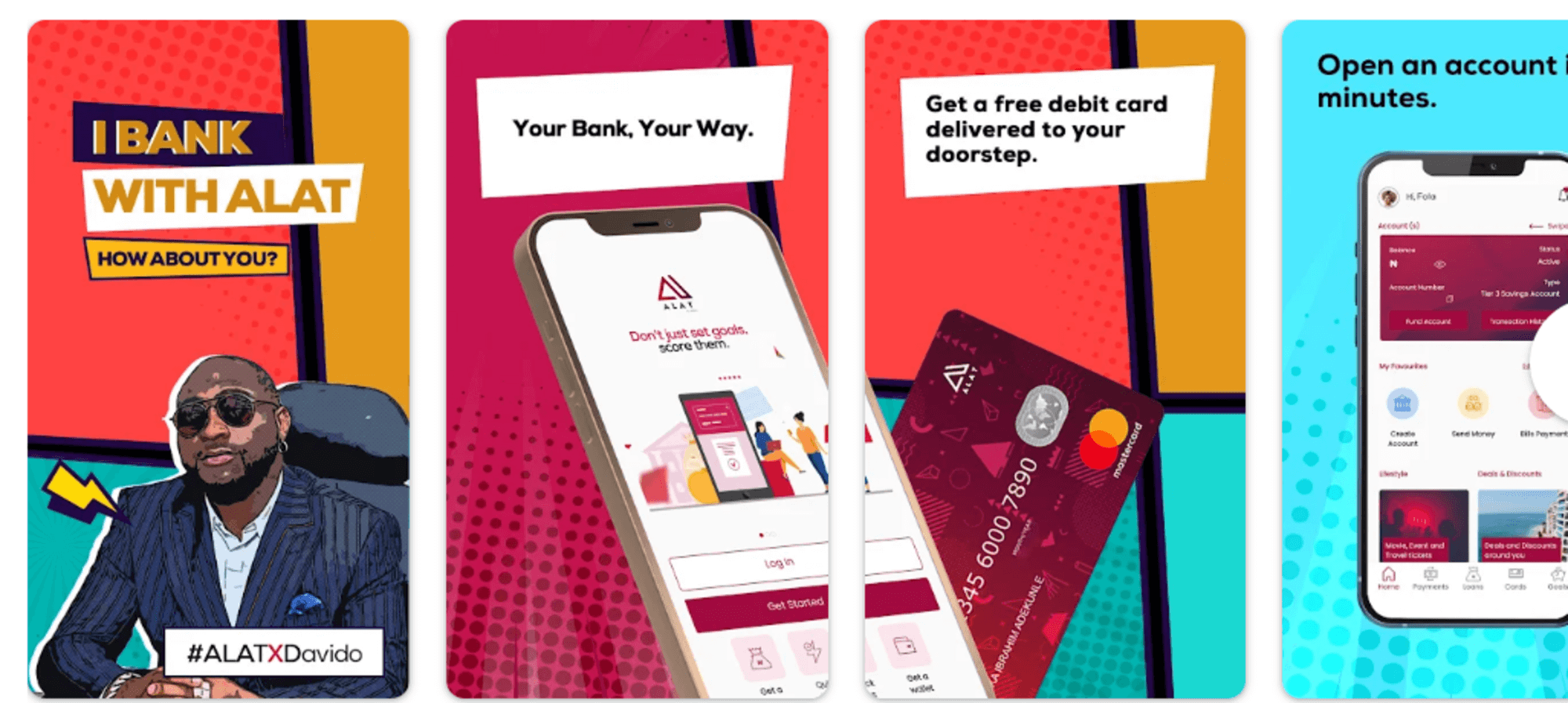

ALAT is a digital banking service created and developed by Wema Bank- one of Africa’s indigenous banks. Launched in 2017, ALAT by Wema is the first Nigerian fully established digital bank.

With the digital bank, one can perform any financial/ banking transactions and even get a loan against their salary to repay on Payday without having to visit any Wema bank physical branches.

Table of Contents

Benefits

- The digital bank supports the opening of bank accounts, receiving and transfer of funds, paying bills, and even receiving a free debit card which can be delivered to its customer anywhere and anytime.

- It is safe and secure. Before every login on the mobile app, the ALAT user is always given a verification prompt on their inputted email address to verify authenticity.

- With the app users can perform a variety of business transactions at a go and also receive instant loans with flexible interest rates to enhance their financial dignity.

- The app offers a goal feature that enables users to save money towards the actualization of their goals and also earn interest on money saved.

- Unlike many mobile banking applications operated by banking institutions, the app supports free debit card delivery and also allows debit card activation on its app.

How to Register on the ALAT by Wema Mobile Application

Here is how to successfully sign up on the mobile app:

- Download the app (it is supported for Android and IOS devices) from your smartphone’s play store.

- Install it and proceed to open the app.

- On the app landing page, tap on “Get Started” to register. Then click on “continue” to proceed further.

- Choose the type of account you have and enter all required basic information on the registration page also validate your BVN and signature.

- Take a Selfie photo to verify you are human and create a profile.

- After creating your profile, you should secure your mobile account. Enter your Email address and password.

- Choose your security question and its matching answer to help keep your account safe and enter your referral code(optional).

- Then log in to the app to get your ALAT account number.

About ALAT by Wema Goals

- The Goals feature allows users to conveniently save money to meet their needs.

- ALAT goals is divided into fixed goal (save daily or weekly towards a target amount with withdrawals restricted until set withdrawal date), Flexi goal( daily, weekly and monthly savings with 50% withdrawal allowed), stash( save any amount at any time with no withdrawal permitted ).

- The ALAT by Wema presents a unique way of savings and also getting interest for money saved. The Stash goals give interest for money saved after 30 days Fixed goal is eligible to receive interest after the user has reached the target amount he saved for.

- With ALAT by Wema goals, users can earn up to 10% per annum.

The Goal-based loans and ALAT Salary loans

- Users of the ALAT by Wema goals feature can also apply to receive a Goal-based loan to meet their financial needs but they must have a goal savings amount of at least 100,000 naira to be eligible.

- ALAT by Wema also offers salary loans which is an unsecured(no collateral) financing package offered by Wema bank to salary earners through the ALAT mobile app, users must however be a salary earner and show proof of earnings

- ALAT loan offers are up to 2 million naira, without collateral required, and a flexible interest rate of 2% for a repayment duration of 3-24 months.

- To apply for the ALAT by Wema loans, you can simply log in to the ALAT app, navigate to the “Loan” tab on the ALAT dashboard, click on it and select your loan type to apply.

About OUTLET by ALAT

- Did you know that ALAT by Wema also supports businesses? Yes, ALAT by Wema is also a lifestyle service.

- You can conveniently explore its service options and pay bills as well on its OUTLET. As a business provider, you can also leverage this ALAT by Wema unique feature to sell your services and make money.

- To pay bills on OUTLET for services, go to “Bills Payments” on the ALAT by Wema dashboard, select the type of bill you would like to pay from the services category, and follow the instructions to successfully make the payment.

Final Thoughts

ALAT by Wema is fully equipped to meet every ALAT user’s financial needs. The ALAT app is CBN licensed and NDIC insured, this implies that is a safe, secured and reliable platform you can trust with your financial details.

so much interested in

this

love everything about Wema