After the introduction of synthetic indices in 2017, Deriv (formerly known as Binary.com) developed the Volatility indices as one of its assets for traders who had interest in trading and investing in markets that was void of fundamental interferences and also ensure optimum trading with profitable withdrawals on a daily including weekends and holidays.

Learn the Secret of Forex Trading, Click here to download a free e-book now

Deriv being one of the most prolific brokers in the world further divided the volatility indices into two tradable assets. The slow-moving volatility asset (Volatility) and the fast-moving volatility assets [Volatility (1s)]. Before 2022, the fast-moving volatility asset [Volatility (1s)] was called High-Frequency Volatility Indices and was denoted as Volatility HF. This was done to show that although both assets are volatility pairs, one is marked by a high rate of price movement when compared to its similar counter-asset. With the change in name and certain characteristics, Volatility HF is currently known and traded as Volatility (1s).

In addition, other Volatility assets are being introduced over time by the broker as Contracts for Difference (CFDs). This is to give traders a wide range of tradable preferences as these assets have unique non-correlated variations with each other.

Table of Contents

What is Volatility Indices?

This is a type of synthetic indices asset which has a quote value as its unique way of identity from other volatility assets. Primarily, volatility indices are denoted with quote values such as 10, 25, 50, 75, 100, 150, 200, 250 and 300. Each of these is designed to give a specific level of speed and market price capitalization depending on the asset traded.

The Volatility indices comprise assets such as the Volatility and Volatility (1s) assets thus:

- Volatility (10, 25, 50, 75, and 100). while

- The Volatility (1s) assets comprise [10(1s), 25(1s), 50(1s), 75(1s), 100(1s), 150(1s), 200(1s), 250(1s) and 300(1s)].

These two types of volatile assets differ in speed of price movement (based on quoted values of 10, 25, 50, 75 and 100) and market price capitalization (depending on how big or small the market price is).

Why are they Important?

Volatility indices was developed as one of the foundational assets in synthetic indices trading. The market was designed to simulate its price movement like the real market asset. Although volatility indices move similarly to forex trading pairs, the unique part of the asset is that it comes with variations in terms of speed and market value.

The indices for determining how fast each volatility market moves lie upon the ascending quote value and the market price capitalization of the asset. In other words, if a volatility pair has a higher quote value but reduced price capitalization, such may be less volatile. And, if an asset has a high quote value and increased price capitalization, such will be very volatile. To bolster these points, Volatility (1s) assets are much more volatile than Volatility assets of the same quote value.

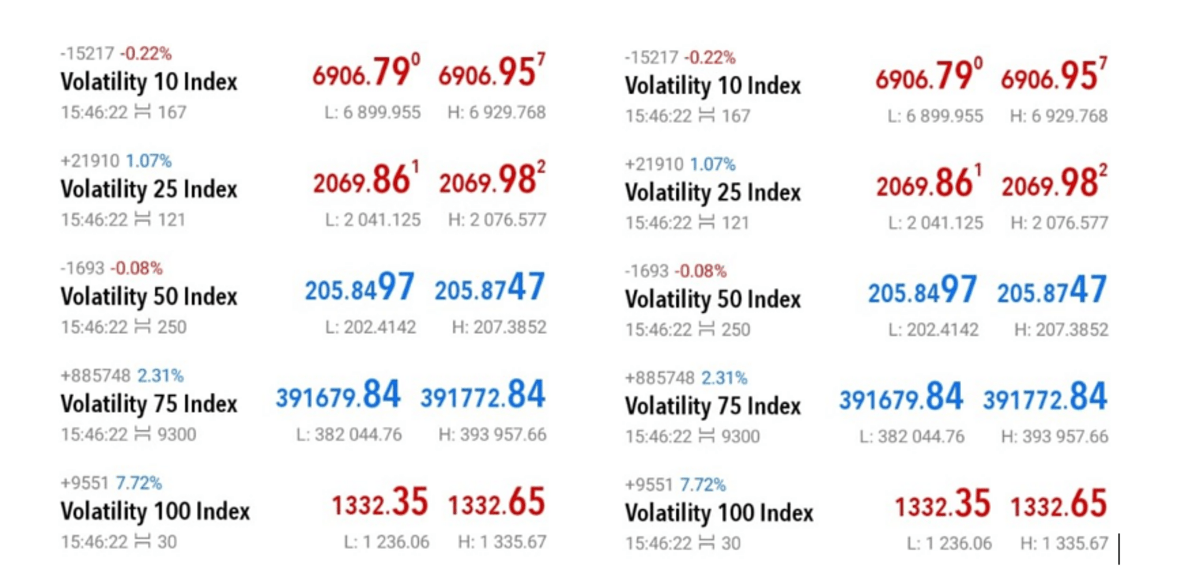

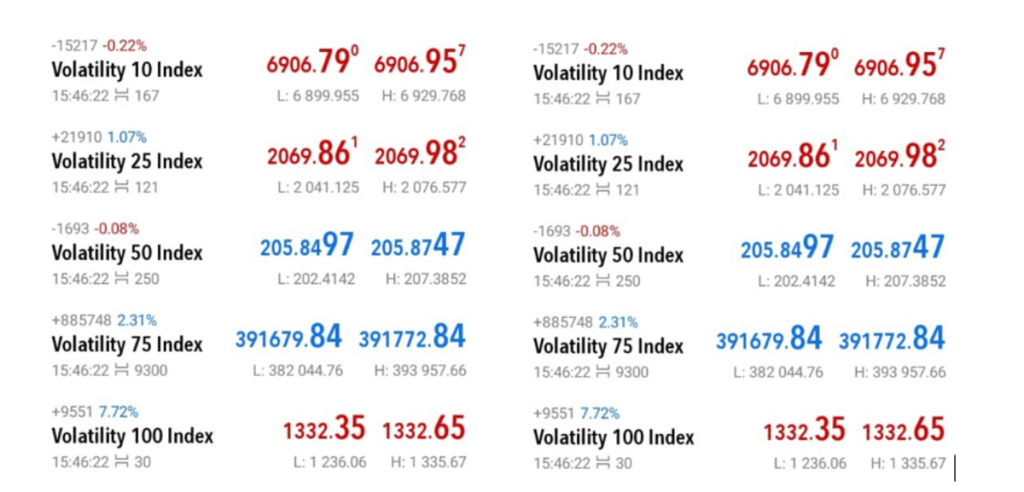

FIGURE 1: A PICTURE SHOWING THE QUOTE VALUES OF VOLATILITY INDICES AND THE DIFFERENT MARKET PRICES

Regarding speed, volatility pairs were developed in ascending quote values to signify that the higher the quote value, the higher the speed of price movement. Conversely, this also applies to its close counter-traded asset [Volatility 1s)]. In the same way, a volatility asset with a higher market price capitalization seems to be more volatile than a Volatility asset with a lower price capitalization. This applies to its close counter-traded asset [Volatility 1s).

In terms of speed, volatility indices are developed with an ascending level of speed in each of the market assets. This implies that a volatility pair with a higher denominational quote value has a higher speed characteristic than those with a lower quote value. For instance, it is expected that Volatility 25 has a higher speed value than Volatility 10, while Volatility 50 has a higher speed value than Volatility 25. As a result, the volatility pairs were developed in an ascending order of volatility per asset per volatility type.

Regarding market value, volatility indices assets were developed to vary in market price capitalization. This implies that where one of the Volatility assets may have a price value of 2073.435 USD and 2073.817 USD as the bid and ask price, another volatility asset may have a non-correlated market capitalization value of 400564.51 USD and 400571.62 USD as the bid and ask price. For instance, while Volatility 25 may have a market capitalization value of 2073.435 USD, Volatility 25 (1s) may be 400564.51 USD.

These variations were introduced to cater for the needs of different types of traders. As it is known, some traders are naturally in love with slow and steady markets, while other traders may choose to focus on fast markets. Depending on the trading preference of a trader, the volatility series was developed to suit such preferential needs of choosing to trade on either slow – or fast–moving assets.

How to Trade Volatility Indices Successfully

Just like every other synthetic indices asset, a successful outcome of any trade depends upon several factors. These include:

-

A good understanding of the asset

Volatility indices assets are non-correlated in nature. This means that, from the numerous synthetic indices’ assets, none has a relationship with each other. So, there is no way a trader can convincedly say that when this volatility pair is moving up, the other is coming down. Due to this reason, a trader needs to understand basic hidden concepts about the asset such as

- How many points does this volatility asset move per day

- Is the asset a volatile or non-volatile asset?

- What is the margin requirement for the asset?

- What method of technical analysis does the asset obey? Is it just support and resistance? Is it trendlines? Is it fair value gaps and order blocks? Etc. This is because, what works for the goose may not work for the gander.

Therefore, a good understanding of the asset is one of the surest ways to have a profitable adventure in any volatility asset traded.

-

A reliable trading system

A trading system is simply a trading strategy that a trader has mastered.it includes a back-tested history and a reasonable risk-to-reward ratio that makes for an acceptable trading exercise. For instance, a trader who specializes in price action trading may tend to prefer trading volatile assets in the volatility series while a trader who focuses on indicator trading may tend to look out for day trading opportunities. For each of these trading systems, success is guaranteed if the principal point of mastery is well learnt. Like I always say, every trading system is a profitable one. The real issue is a trader who is yet to master the pros and cons. For that reason, seek a profitable trading system, develop yourself on it and grow. If you need a mentor or coach on this, kindly reach me to teach you to a state of profitability through juvirtrdes@gmail.com.

-

A good risk-to-reward ratio

This holds the key to every successful trading outcome in the long run. This is because, a trader must know how much he/she must take as a risk or potential loss for every open position taken. In addition, trading is not an infinite exercise. Every trend or range that has a beginning has an end. For that reason, having a potential exit position is as important as life. That is because, one should presume where he/she should exit the market. In terms of reward, this should be calculated using specific ideas such previous zones, points of interest and Fibonacci extension levels (and not a daily target). Using a daily trading target as a basis for reward has caused so many traders to lose the money they would have secured. For that reason, having a good risk-to-reward ratio is very important as this will help you to know that trading slow Volatility asset should focus on less points while those with high market price capitalization can give more than 500 pips in a day.

N/B: Trading Forex is risky, always risk what you are willing to lose

If this publication has been helpful to you and kindly do the following

- Signup on my YouTube channel at https://www.youtube.com/c/juvirtrades

- Sign up for my mentorship through juvirtrades@gmail.com.

- Open a free demo/real account under the Deriv.com, by clicking here

- Join my free WhatsApp group https://chat.whatsapp.com/HJ2Lz96W378BJVfsQ5nU2F

- Contact me through a direct call on +2348027790183.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.