A treasury bill is a financial instrument(security) where an individual known as investor loans the federal government money for a short-term period. They are usually issued when the government needs money for a short period to engage in several government projects. This article aims to share all you need to know about treasury bills in Nigeria and how you can invest in them.

Table of Contents

What are Treasury bills

The history of the bills can be traced to India where it was first issued in 1917. The bills in Nigeria were introduced in April 1960 and it was issued as a 90-day monetary policy to enable the government to finance government projects and also used as a control tool.

Treasury bills are the most used and popular of the Nigerian government securities available to the public, you should leverage this opportunity and invest to earn satisfactory returns.

Key Things To Know

- They are backed by the federal government and they are safe investment options.

- Treasury bills in Nigeria exist as 91-day, 182-day and 364-day (a year) tenures.

- They do not earn regular interest like bonds or stocks do.

- To purchase the bill you would have to do so through the federal government-approved RBIs which are; the CBN, banks, brokers etc.,

- They offer low returns compared to high-risk investment plans.

- They are taxable; this means implies you would have to pay tax on them upon their maturity.

- Also, the rate of yield earn depends on the type of the bill invested. Yearly bills have a higher yield rate than 3 months bills and vice versa

Advantages of Treasury bills

- Transparency: The treasury bills in Nigeria are reputed for their transparent feature. The discount per value is always published before treasury bills are released. This helps to prevent issues of exploitation of willing investors by the channels they choose to bid on treasury bills from.

- Risk-free : Treasury bills have zero risk. This implies that your investment is secured is assured. Even, during an economic crisis, the government is liable to repay the loans within the stipulated date.

- Liquidity : Individuals looking to generate short-term gains through secure investments can bank on the treasury bill plus, treasury bills can also be sold in the secondary market, over the counter(OTC) through a broker during emergencies.

- Non-competitive bidding advantage: One of the features of treasury bills is that they are auctioned with no bidding. This allows a different range of investors to partake in bids thus, making it possible for anyone who can afford to invest to do conveniently so.

- Treasury bills serve as a financial planning tool on which wealth grows.

- Treasury bills are steady sources of earning income and they can also suffice as a means of saving money.

How Do they Work?

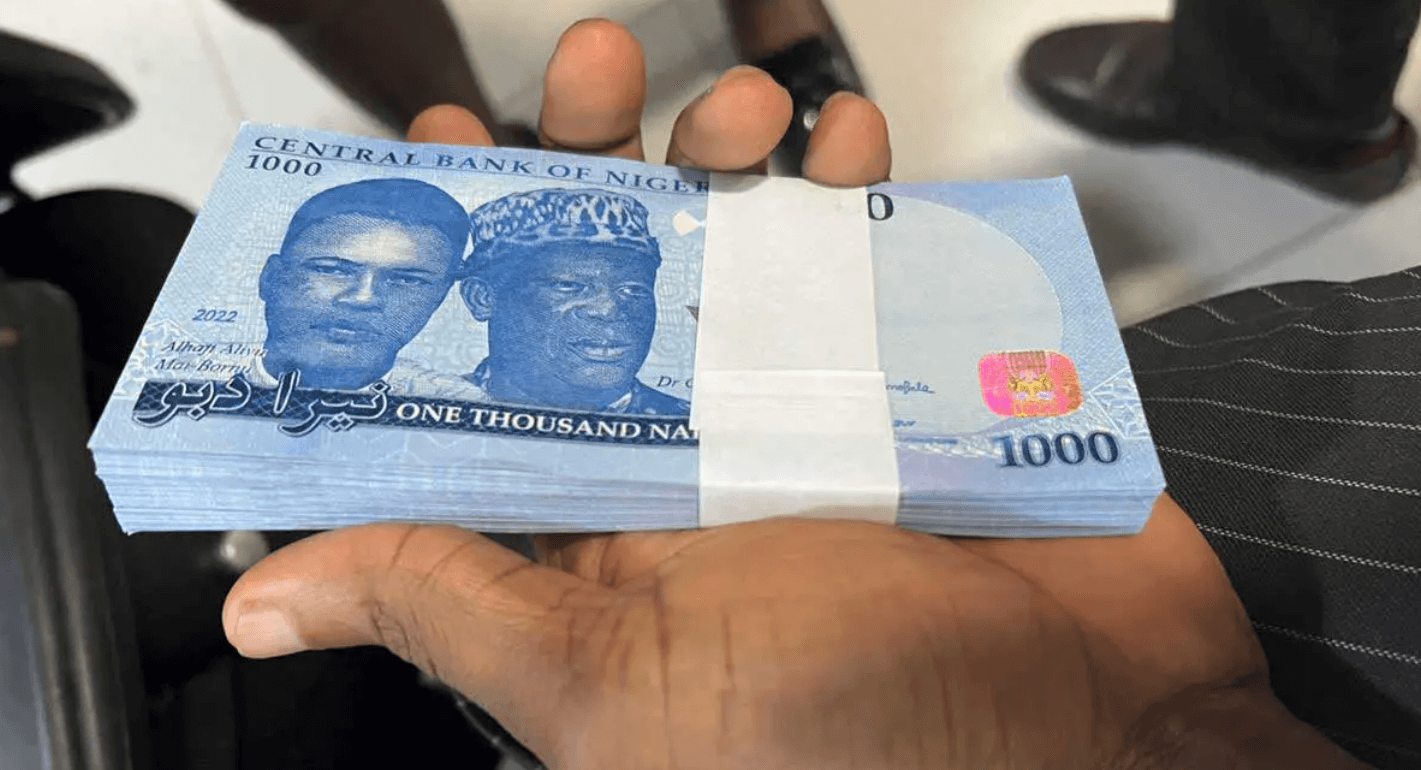

Treasury bills are displayed and sold during biweekly auctions by the CBN to buyers who will have to quote the bid. After, the bid quote, the federal government selects the average minimum bids and proceeds to sell them at a lower price than the stated face value(which is the financial value for security stated by the issuer) to the buyer.

Investors will have to hold on to the bids until the specified maturity date which they would be paid in full the face value price for it. For example a 200,000 naira pegged treasury bill is sold at 180,000 naira (with a discount) by the government. On maturity, the government pays the sum of 200,000(full price) to the buyer instead of the 180,000 naira the buyer had purchased it.

How much can be invested in a Treasury bill?

The minimum amount of investment on a treasury bill is 50 million naira. Still, many commercial banks allow a minimum of 100,000 naira investment from their customers which they proceed to invest on their customer’s behalf through the use of a portfolio and pay interest earned upon the treasury bill maturity.

Who can Purchase a Treasury bill?

In Nigeria, treasury bills can be purchased by corporate bodies(private and public), banks, brokers, discount houses, individuals and public/private institutions.