If you are struggling in your Forex trading journey, I am here to tell you that you are not alone. I started my forex trading journey with just $10 and it was not easy at the beginning but with patience and consistency I have grown my $10 account to over $6,000 within 10 months; with monthly withdrawals of at least $200. So how did I do it?

Don’t be left out, Learn how to trade forex the right way, Click here to get started

Table of Contents

How I Started my Forex Trading Journey.

Let me give you a little background, Late 2017, I read a story about a South African Forex trader who made over $2,000 in one trade in a single day. Then I was managing a cybercafé for my uncle, and that story inspired my interest in Forex, so I enrolled for a forex trading course with the guy, paid him $200 from my saving with the hope of making at least half of that amount weekly.

After two weeks of back and forth lessons, I opened my first trading account with a deposit of $200, blow the account in less than 3 hours. Because of that horrible experience, I deleted MT4, forget about forex and continued my Cybercafé work.

The cybercafé was booming and I was enjoying good profit, especially from printing, photocopy and typing since the café was located close to a University. Then one day, COVID-19 struck, there was a national lockdown and we were back to default setting.

Don’t be left out, Open a free trading account now by clicking here

After staying at home for about 3 weeks, I came across an article on Boom and Crash on Motivation Africa so I decided to use the little knowledge I had on forex plus the advise from the article to play with the market small.

I opened a trading account on Deriv, deposited just $10; the first trade I took was a sell on crash 500 and I had a profit of $5.55, It was too good to be true, this result inspired me to read and research more on Boom and Crash, but the materials I saw online were merely basic stuff, things I really needed to understand like Supply and demand, market structure, candlestick pattern, etc were just basic no in-depth explanation.

So what did I do?

The best way to learn trading is through trading; that is while demo trading is good.

The Broker

I choose a broker that has asset that was tradable 24/7 with the same spread and leverage. This was because I wanted to have the ability to balance my trading with the others I was pursuing in life, for instance my MSc program.

Demo Trading

I focused on demo trading for sometimes; developed my strategy, build my confidence, developed a risk management portfolio before going back to my live account.

Don’t be left out, Open a free trading account now by clicking here

The demo account help build my psychology and stamina; I was also able to pick out 4 assets which are the only assets I trade, even till today.

Trading Pair

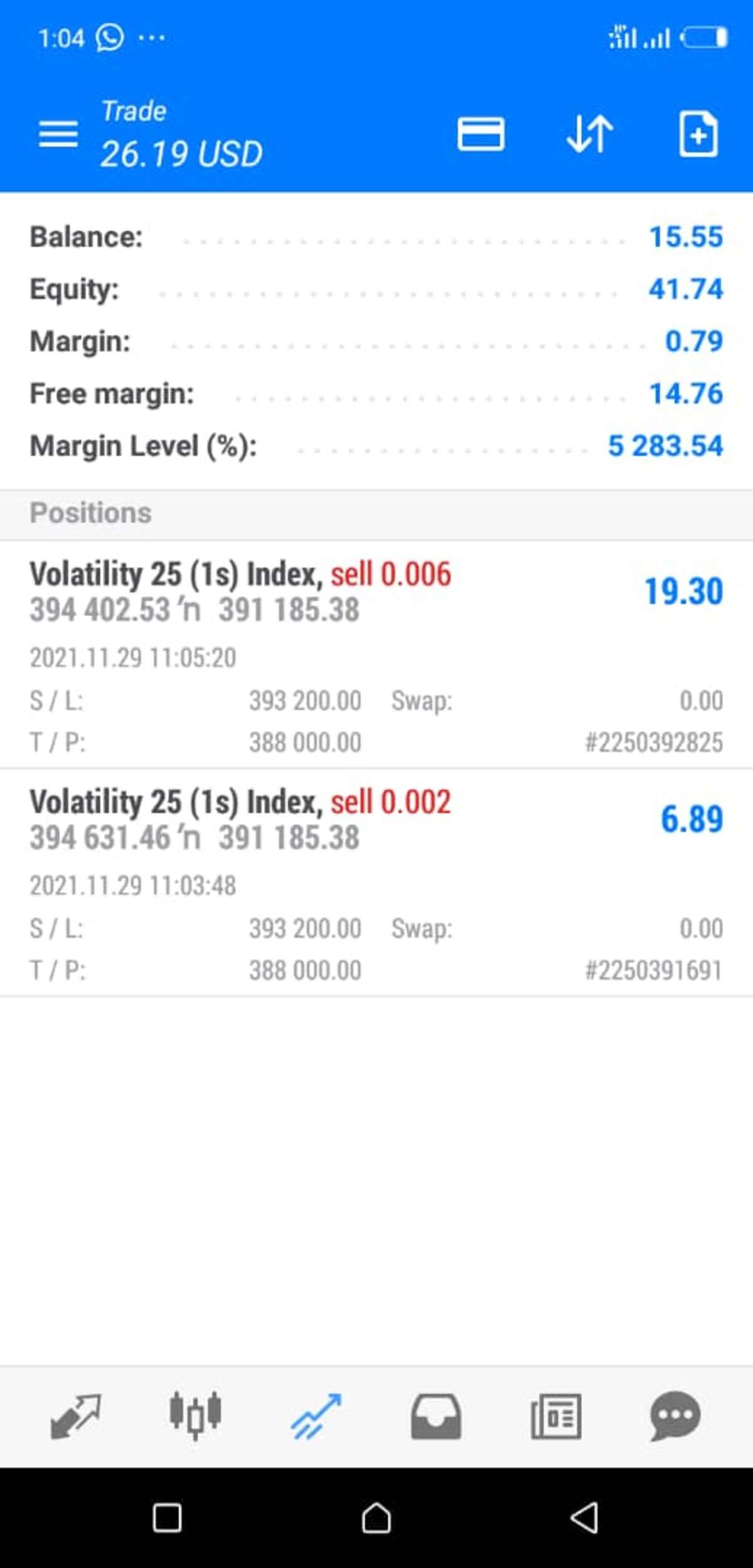

I choose about 3 pairs (V25 (1s), Crash 500 and Boom 500. Trading just these 3 pairs give me the time and the opportunity to study the market history, understand the pair and develop my strategy to suit my trading style.

My Trading Strategy

My strategy is mainly price action. I trade with the naked charts. The first thing I do every morning is to draw support and resistance line, then wait for price to get to those lines before making an entry.

This what you should do as a beginner.

- Open a demo account – Your demo account should be a training ground for you where you build your psychology, strategy, confidence and stamina.

- Read on Price action, Candlestick pattern, and supply and demand – If you understand these three concept, you will enjoy trading.

- Start trading on your real account – Once you understand the above concept, start trading on your live account but learn how to manage risk effectively.

- Continuously seek for more knowledge: Trading is dynamic, new knowledge and strategy emerges daily, but they do not nullify those life long concepts, so keep your ears open for new strategies but carefully study them before applying them.

Final Thought:

Trading with a little capital is challenging but very rewarding, Brokers like Deriv gives you the freedom to start your trading journey with as little as $5. But if you are starting with a small capital please risk properly.

All the best.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.