If you are looking for how to start trading forex with just $10, then you have to ask yourself this question “is $10 enough for me to make a DECENT living as a forex trader?” To be honest, the answer is both no and yes.

Don’t be left out, Learn how to trade forex the right way, Click here to get started

No, in the sense that the forex market is very risky, one wrong trade in a very volatile pair can wipe away the entire $10 in just few minutes.

Yes, in the sense that a good trading strategy can enabled you double your account within minutes, secondly a $10 account can be a good test of your emotions, patience and risk management skill in your forex learning journey. In this article, I will share some tips and strategy that will help you grow your forex account with just $10.

Table of Contents

How to Start Trading Forex with Just $10

Let me be clear, forex trading is not a get rich quick scheme, but you can make a decent living from forex trading. In this your journey of learning how to start trading forex with just $10, these few tips will be very helpful.

Know when to place a trade

Knowing when to place a trade is very important especially if you want to win in the market. This is where your trading strategy comes in. Your trading strategy will look at:

- The trend of the market

- Point of Interest and Entry

- Point of Exit and Take Profit

Step 1: Know the Trend of the Market

There are three trends in the market. We have Uptrend, downtrend and Sideway trends. Uptrends are signify by a series of higher high and higher low; Downtrend are signify by a series of Lower Low and Lower high; While sideway trend is a ranging market without any clear direction. Sideway trends are majorly points of indecision in the market.

Knowing the trend of the market and following the trend of the market is very important if you want to make money from the market.

Using visual inspection without any special indicator can help you determine the trend of the market. You need to start from the Daily timeframe, consistent higher high and higher low will signify an uptrend, while consistent lower high and lower low will signify a downtrend. Then switch to M5 timeframe for point of interest and entry.

Step 2: Point of Interest (POI) and Point of Entry (POE)

Once you have determine the trend of the market, the next thing is to mark out your point of interest and point of entry in the chart. Point of interest are normally your core areas of interest like Support and resistance, reversal points, etc., You need to look at where price bounce off more than twice based on market history, those points will form your POI.

Your Point of Entry (POE) can be decided based on the reaction of price at your POI, let say, from the market history, there is a candlestick pattern that is formed at your POI before price can bounce either up or down; so you need to come up with some “if statement”, for instance if price gets to a certain point or break a certain point in the chart with a strong momentum, I will buy or sell. These “If statements” are what will determine the point of entry

Point of Exit (stop loss) and Take Profit (TP)

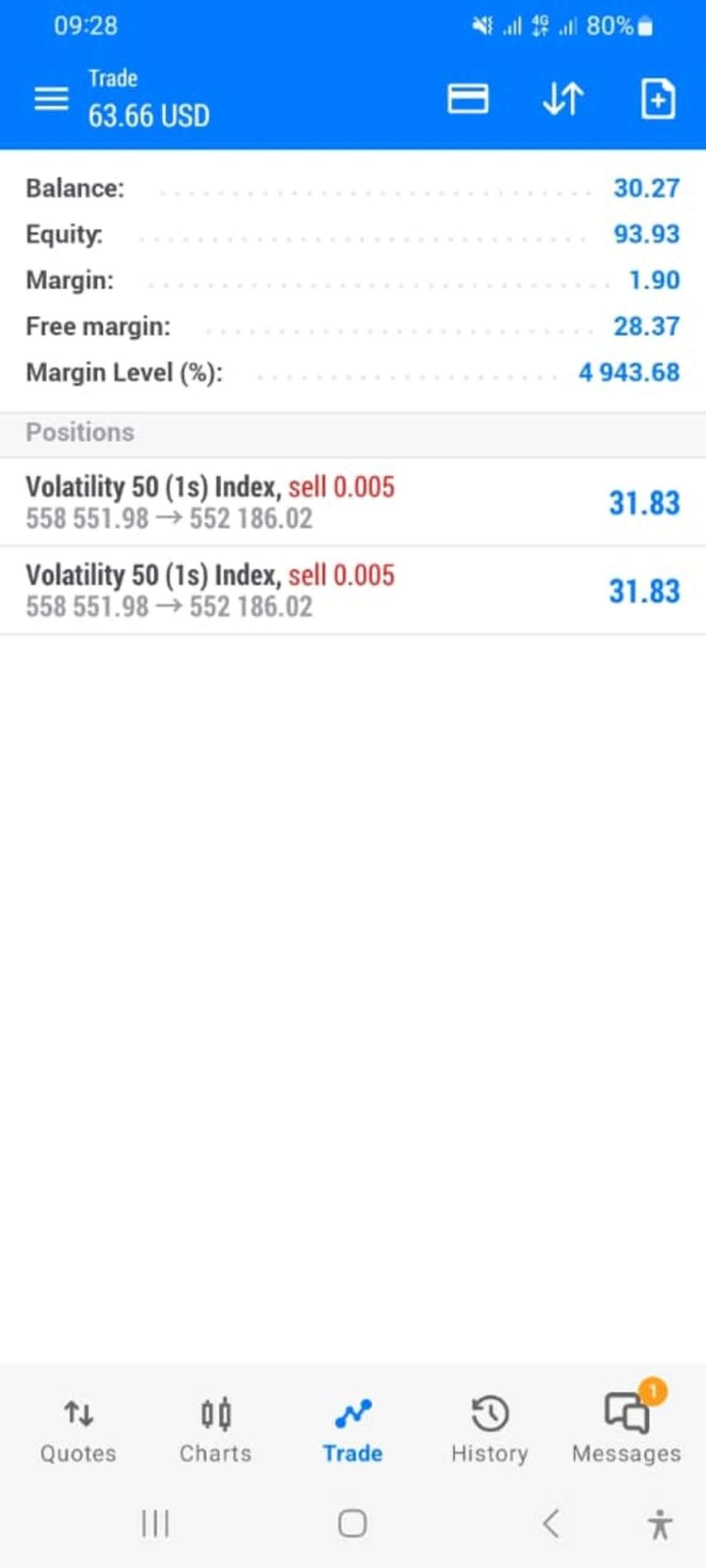

For a $10 account, you need to risk 10 to 15 pips per trade with a considerable lot size. This will be like risking $1 to $2 per trade with the aim of getting up to $3 to $5 per trade or more.

Point of Exit is your stop loss, It’s important that you don’t risk more than $2 per trade; this means that it will take about 5 losing trades before you blow your account. You can look at 10 to 15 pips below your entry position for stop loss for a buy, then 10 to 15 pips above your stop loss for a sell.

For take profit, please don’t open any trade and close with 10 cent profit, because you wont grow with that kind of mentality. Your take profit should be from $5 for every trade you open, so that you have the opportunity to flip your account with just 2 good trades, then grow from there.

For instance, you can take your $10 account to $20 with 2 trades, then $20 to $40 with 2 trades, etc.,

Final Thoughts on How to Start Trading Forex with Just $10

If you want to make money with a small account, PLEASE AVOID low probability trades. Don’t just be in the market for the sake of being in the market, if you don’t see any opportunity that matches your “if statement” on your Point of Entry section, please don’t enter the market.

Finally, don’t glue yourself to the chart when you open trade because there is nothing you can do once you place a trade, just allow it to play out.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.