Digital lending has become a lifeline for many Africans who need quick cash to cover urgent expenses. With just a few clicks, you can download a loan app, apply, and get money directly in your mobile wallet. But while loan apps are convenient, not all of them are genuine. Fraudulent apps have been on the rise, targeting people in urgent need of credit. These apps can misuse your personal data, charge illegal fees, or even vanish after you make payments. If you’re thinking of downloading any loan app in Africa, here are four critical red flags you should never ignore.

Table of Contents

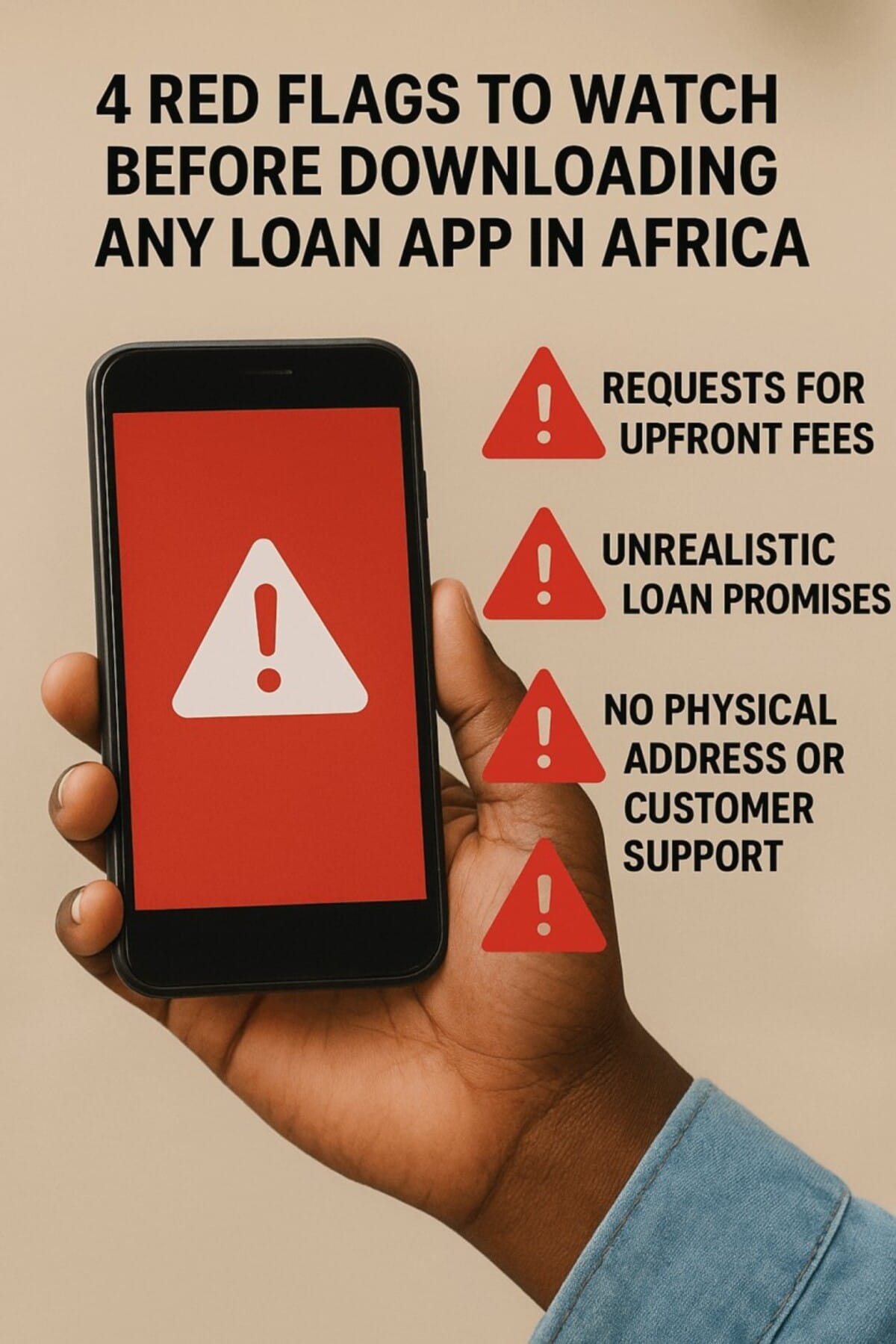

4 Red Flags to Watch Before Downloading Any Loan App in Africa

1. Requests for Upfront Fees

One of the most common scams in Africa’s loan app space is asking borrowers to pay processing, insurance, or verification fees before a loan is approved. Legitimate financial institutions deduct such charges from the disbursed amount, not before. If a loan app demands an upfront payment, it is very likely a scam.

2. Unrealistic Loan Promises

Be wary of apps that promise instant approval, no eligibility checks, or extremely low interest rates. Every genuine lender checks your creditworthiness, income, and identity before approving a loan. If a loan offer seems “too good to be true,” it probably is. These traps are designed to lure desperate borrowers into giving away money or sensitive data.

3. No Physical Address or Customer Support

Before downloading any loan app in Africa, confirm that the lender has a verifiable office address and functional customer service channels. Scam apps often operate only through WhatsApp, social media, or anonymous emails. If you cannot find a physical office or reach a real customer service team, take it as a big red flag.

4. Pressure Tactics and Data Requests

Fraudulent loan apps often push borrowers to act quickly, claiming that the offer will expire soon. Genuine lenders never rush borrowers or demand confidential information through insecure channels. Sharing such details can lead to identity theft or unauthorized withdrawals.

Final Thoughts

Loan apps can be helpful, but they also come with risks. Before downloading any loan app in Africa, always:

- Verify registration with financial regulators.

- Avoid apps that demand upfront fees.

- Question offers that sound too good to be true.

- Confirm the lender’s physical presence and customer support.

- Protect your personal and financial information.