Last month, one of my friends asked me to share my Boom 1000 trading strategy after seeing my trade results on Boom 1000.

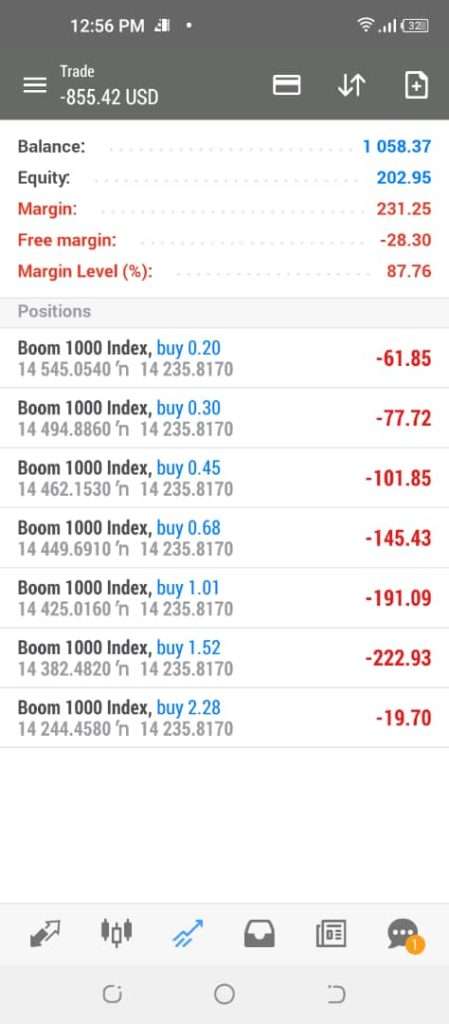

After reviewing his trading history (picture below): I decided to write down this guide for him and anyone else struggling with understanding Boom 1000 or B1000 f0r short

One of the problem I have with some traders is over leveraging; it’s true Deriv is one of the most trusted Broker and their leverage and margin level is very good. But that should not give you the liberty to open so many positions at interval without studying the market structure.

Please, If you want to succeed in the forex market do the following:

1. Become a Smart money forex trader:

If you have never heard of the smart money forex concept before, click here to download a comprehensive guide by Phil Gangluff. To tell you the truth, risking more than 10% of your capital in a trade is suicidal. Success in Forex is consistency not a one off affair.

2. Back-test all your strategies on Demo before using a real account:

In all my e-books and articles on Forex, I have emphasizes the important of back-testing your strategy on your demo account first before using your real account. Personally, I don’t keep demo account long on my trading platform, I only open one when I want to make some adjustment to my strategy. So please, Open a demo account, use it to test your strategy, adjust what you need to adjust, once you are satisfy, delete the demo account and continue with you real account.

3. Be a target based trader:

This where most newbies get it wrong. The different between me and many Forex guru is that I am a target based trader. I have a daily profit and loss target, once I meet any of them, I exit the market for the day. Once I exit the market, I will sit back and review my trades for the day and if I have any red on the trading history, I will try to uncover what I did wrong, then prepare for the next trading day. I always put stop loss and take profit on all my trades.

Let’s look at the Boom 1000 trading strategy that will improve your trading Journey.

Table of Contents

My Boom 1000 trading strategy

- This strategy is not the holy grail, but if you follow it to the later it will improve your trading journey.

- This strategy works together with price action, you must understand the market structure before using the strategy

The Settings

- On the main chart add Exponential Moving average 21 apply to close.

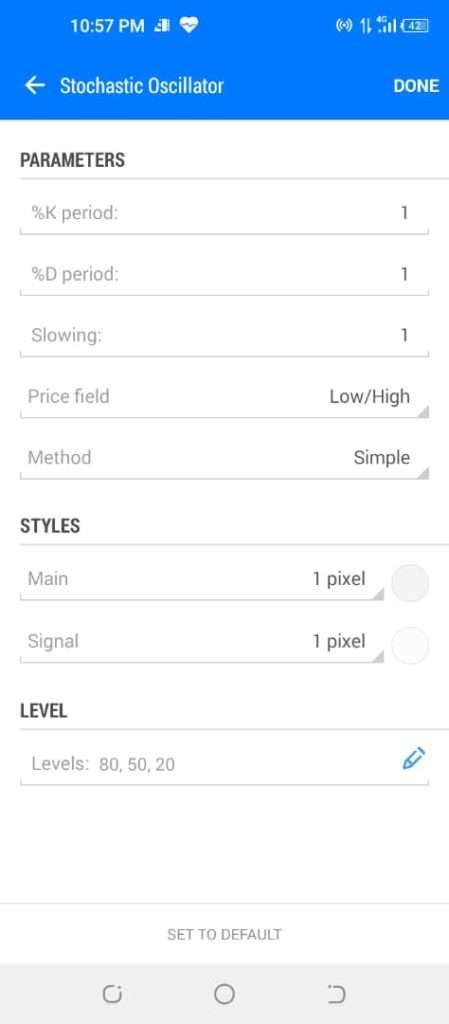

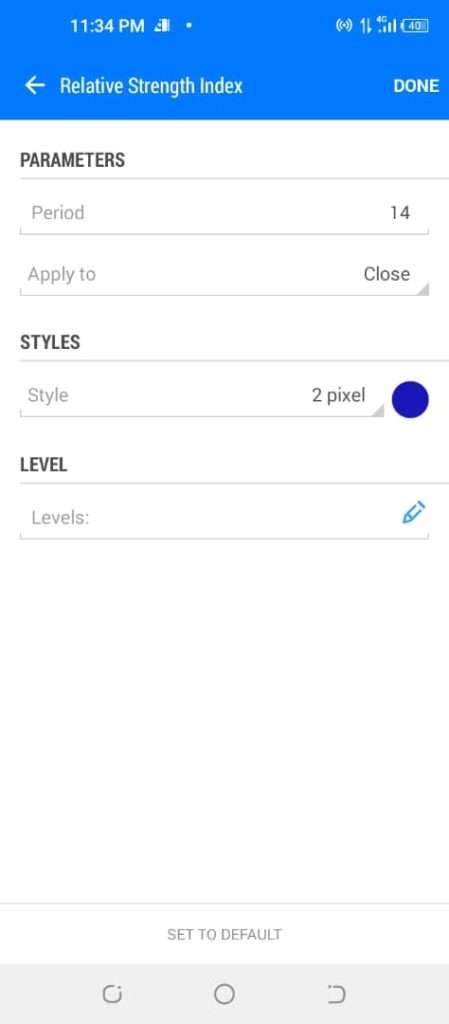

- On Indicator window 1 add stochastic and RSI ( screenshot below)

Stochastic Oscillator

RSI period 14

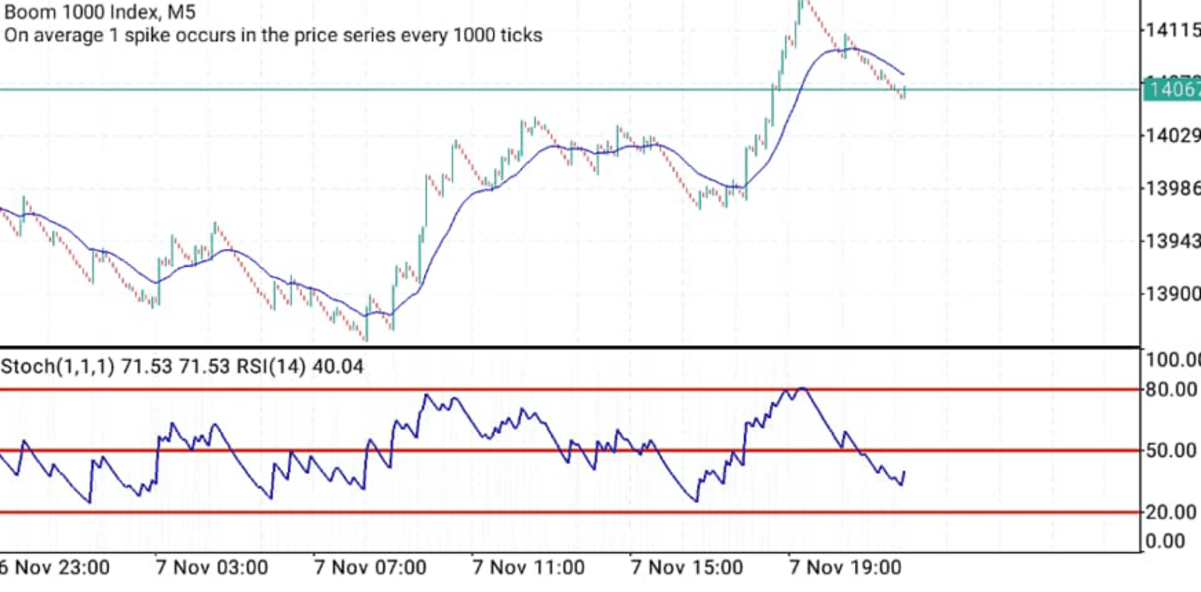

This is how your chart will look like after adding the indicator.

How to get signals for your B1000 trades

- Look at the Market Structure on H4

- Once you understand the market structure on H4, switch to M5.

This is the condition for buy. (Make sure your decision is informed by the market structure on H4)

- RSI line should be at or close to the 20 stochastic line

- The price action should be trending above the 21 EMA (21 EMA mostly act as a support on uptrend, if there is a little retracement)

- Once this two conditions are met, buy and ensure you put your TP close to the next Resistance zone and your Stop loss slightly below the support zone.

This is the condition for sell. (Make sure your decision is informed by the market structure on H4)

- RSI line should be at the 80 stochastic line

- The price action should trending be below the 21 EMA (The 21 EMA also serves as a resistance point on downtrend)

- Once this two conditions are met, sell and ensure you put your TP close to the next support zone and your Stop loss slightly above the resistance zone.

N/B: Always cut your profit even, if you notice a violation of the market structure, like moving stop loss into profit to secure some profit or closing the trade out rightly to secure your profit.

Conclusion

This strategy has worked for me, and the win rate is over 90%; always remember that trading forex is risky and you may lose all your capital if you don’t have the right knowledge or you don’t follow your strategy. Please trade wisely. If you have any questions, kindly share on the comment box.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

Please I need à good explanation

Can I have your whatssap

That is mine

+237690401988

Hello sir,,,, this is great to have heard from you just that I need some more info from you sir,,,, kindly text me +254711180774