If you are a newbie or a struggling forex trader, then this article on how to trade synthetic indices as a Beginner should be your starting point in your journey into the Forex Market.

Learn the Secret of Forex Trading, Click here to download a free e-book now

Don’t let anyone fool you, there is so much money in the forex market, but it’s not that easy to make good money from the market; you need knowledge, patience and good risk management. In this article on how to trade boom and crash as a beginner, I am going to share first-hand knowledge and experience from two of my mentees who grew $50 account to $700 in 3 weeks.

Table of Contents

How to Trade Synthetic Indices as a Beginner

The Background

Boom and Crash are synthetic indices that are programmed to simulate real World market and movement and are based on a cryptographically secure random generator that is regularly audited by an independent third party to ensure fairness.

The definition above is too technical but we are going to break it down as we progress. First, what you need to know is that unlike currency pairs which can be affected by news event, Boom and Crash are not affected by any news event, rather they are affected mainly by Market order.

The Boom Indices which comprises of Boom 1000, Boom 500, and Boom 300 has a default setting of sell, which means if you open any Boom indices, you will notice that it will be on sell with buy (which we call spikes) at interval.

On the other hand, the crash Indices which comprises of Crash 1000, Crash 500, and Crash 300 has a default setting of buy, which means if you open any Crash indices, you will notice that it will be on buy with sell (which we call spikes) at interval.

The Mistakes Most Newbies Makes

One of the mistake, I have noticed most newbies make is trying to Buy Crash and Sell Boom at their initial stage in the market. Most of them just gamble and get big wins without understanding that a little draw-down can wipe out their account.

While buying Crash and Selling Boom is good depending on the market trend, I always advise most newbies to learn how to sell Crash and Buy Boom.

Learn the Secret of Forex Trading, Click here to download a free e-book now

This is why you should Sell Crash and Buy Boom

If you want to learn how to trade synthetic indices as a beginner and you want to be successful, you need to learn how to sell Crash and Buy Boom. I have mentored about 18 people on Boom and Crash this Month and my conversation has always been on the need for them to focus on the spikes and forget about the candles, especially as beginners.

This is because:

1. You can Control your loses

One of the drawn-down of buying Crash and Selling Boom is that if the market decides to spikes, you cannot control the loses, but if you are selling Crash and Buying Boom, you can easily put a stop loss and a TP, close the app and check back to see your trade either closed at a minimal loss depending on your Stop Loss or at a good profit depending on your take profit level.

2. You will Start with Red

If you are buying Boom and Selling Crash, your trade will start running on red until the spike occur. Seeing your trade start in red then turn blue as spike occur is a good confidence booster and a great attribute of patience.

I have done a test-run with my mentees on several occasion, if you are buying Crash for instance, you will see the profit immediately, maybe you plan to take 5 dollar per entry, but as your trade approach 2 dollar, you are contemplating on closing it, but just before you close it, there is a sudden spike that put the trade in a negative of $12, as you are thinking of what to do, another spike occur landing you at a negative of $24.

If you are selling Crash for instance (I will share a strategy, you can work on) and you have a stop loss of say $6 per entry (that is, if it doesn’t spike, once it get to $6, you will close. Then as the trade approach a negative of $4, it spikes down and put you in a profit of $8, if the trend looks good, you can move your stop loss into profit and risk just $4 from the $8 to get up to $20 or more.

So starting with a red, put you on toes to study the market before placing any trade. Whereas, if you are buying Crash as a beginner, you can decide to jump into the market at interval to get just 20 cents per movement which can be wipe out, if spike catch your trade at any point during your 20 cents movement.

How to Trade Synthetic Indices as a Beginner: The Strategy

There so many strategies that can help you to become successful in the forex market as a newbies. I am just going to share one, hoping that you can work and develop it to suit your trading style and need as you grow in the forex market.

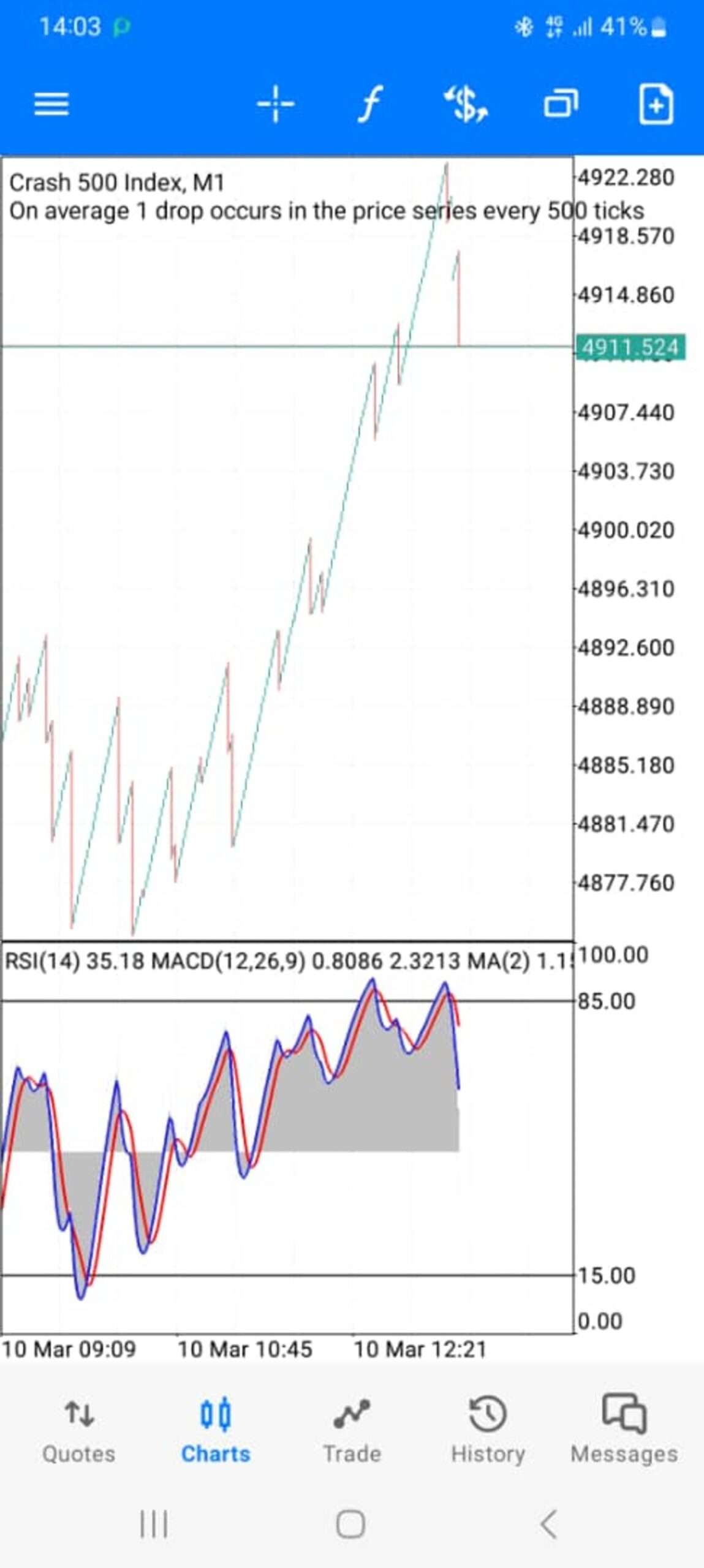

The Strategy I am sharing make use of three indicator viz: RSI, MACD and Moving average.

1. RSI

Add RSI to your Indicator window 1

2. MACD

Add MACD to your indicator Window 1

3. Moving Average

Add Moving average to the chart

This is how your chart will look like after adding the Indicators.

How to place trade Using this Strategy.

The Zoom level is zoom level 2. The Strategy works in all timeframe, but you can start with M1 until you master the strategy.

Sell Crash when the MACD line crosses the overbought zone as shown in the screenshot below and put a $4 to $6 stop loss per entry.

The same goes for boom, buy boom once the MACD crosses the Oversold zone and put a $4 to $6 stop loss per entry.

It is important to wait until the MACD cross the overbought or oversold zones, before jumping into the market.

I hope this help you in your trading journey, if you have any question, kindly leave a comment below this post and I will respond as soon as possible.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

wow i will try these

but i need help on markets like volatility especially 75 index and all that

please

The information on buying boom and selling crash is very powerful and helpful.i did not considered these factors at first before found this article.it has really helped me a lot.the only question I have is that can a person know the specific time that boom and crash spike

Thank you so much for the information, i would want to learn more and more

Can this work on m5? Because mine is m5 and i adjusted to m1 settings.

Can this work on m5? Because mine is m5 and i adjusted to m5 settings.

Can this work on m5? Because mine is m5 and i adjusted to m5 in settings.