If you are looking for a profitable asset to trade on the synthetic market, then try the Step Index. I first encountered the Step index during my low point in the market and my first experience was not good. I had a 200 USD account and I blow the account in just 30 minutes of trading Step indices partly because I was new to the trading conditions that the market present.

Don’t be left out, Learn how to trade forex the right way, Click here to get started

I was not happy so I deposited another 100 USD and started revenge trading; luck was on my side so I recovered up to 70% of what I lost in about one hour. But that approach was not responsible trading. So, after that day, I returned back to my demo account and started learning more about the synthetic market. It took me about 5 days to come up with a workable strategy and almost one months to perfect that strategy.

My golden rule in trading is once you find a strategy that works for you, stick with it, there is no gain in running after every strategy that you see. You will lose some trades, but with constant refining of your trading strategy, gains is imminent. Always remember, no strategy is 100% perfect.

Table of Contents

How to Trade Step Index Successfully

As part of simulated markets offered by Deriv, Step index is not a difficult market to trade, especially when you have what I called your trading purposes, understand how to read market trends, have a good risk appetite, know how to predict price movements just like in forex trading then you can conquer the market.

Please note, this strategy I am about to share is what has helped me to be consistent in the past years in the Forex market, it not only applicable to Step Index, you can use it to trade Range Break, Volatility indices, Crash and Boom and Currency Pairs.

1. Target one good set up at time

I am a price action trader, I love listening to the candle sticks, price movements and the market structure to informed my decisions. The fact is, there are more than 3 good set up in the market every day, you just need one of those set up to make your profit and leave the market for others.

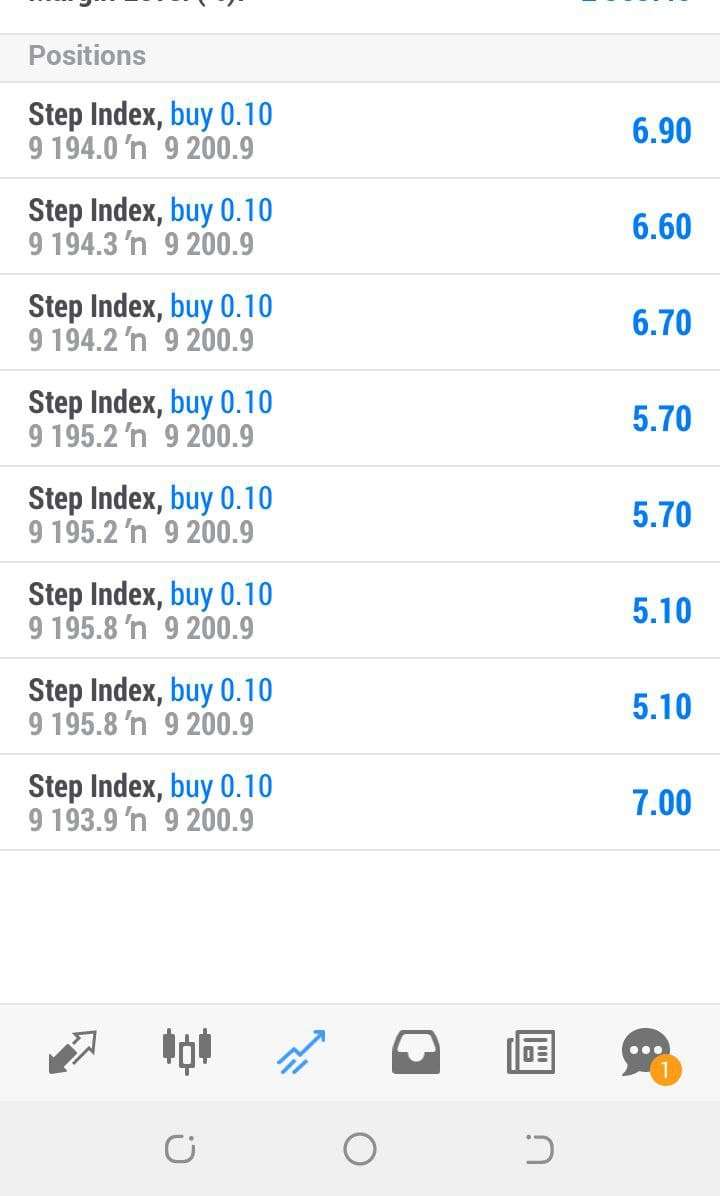

This is what I do every day. I currently have an equity of over $4000; I monitor the set up from Daily, H4 and HI, then use M15 or M5 to find an entry. If you have a low equity account; use M1 to find an entry after seeing a set up on higher timeframe so that you can have a tight stop loss on M1.

I am a fan of take profits and Stop loss, the only way I can close in red before it reach my stop loss is if I spot a market structural violation. So search and spot a good set up, maximize it and exit the market immediately after you hit your daily target

2. Avoid Low probability trades

There is no question about this; trading forex is risky, the only way to minimize this risk especially when trading Step Index or any other Forex asset is to avoid low probability trades. If you want to be a successful trader, you have to stop all those 10 seconds trades. If you cannot spot a good set up that can give you a leverage to stay at least 10 minutes long or short on a trade please stay off the market.

Don’t get me wrong, I am a big fan of 1 minutes, 2 minutes trades if it a high possibility trade and is informed by the market structure not greed.

3. Find a Strategy that works.

There is no overnight success in the Forex, forget all those YouTube Forex Billionaire, things are not often the way they seems; if you are not ready to invest your time and resources to study materials, videos and the market to define a strategy that works for you, then you are not ready to make profit.

Even though, I am making an average of $100 daily trading Step Index, I am still studying the market, books and materials to update my strategy. I don’t study to look for strategy, I study to enhanced my strategy.

If you are struggling in the market, this is what you should do now; Open a Demo Account, you can open one by clicking here. Start by using the naked chart first. Learn how to understand the market structure, candle stick pattern, before you start adding indicators like Fibonacci to spot some key levels in the market. If you understand market structure and candle stick flow, you will be able to identify good market set up, then you can use the Fibonacci to spot a good entry point.

You will start trading based on the entry points from Fibonacci on your demo, keep changing the Fibonacci level until you have a high probability spot that can give you at least 85% win opportunity in the market, if you can spot one or two of this, then you are on your way to being profitable.

4. Forget about the Money first, Master the art.

The reason most trader fail and quit too early is because their only goal in the market is to make money, they see Forex as a get rich quick scheme. Let me tell you this; Forex is just like the real World. In the real World scenario, we have billionaires, millionaires and the poor ; the different between each of them is the information and opportunity available to them and how they are willing to utilize them.

If you want to be successful, build your knowledge first, that is while all brokers have demo accounts. The demo is to help you build your psychology and strategy. Don’t rush in to a real account, if you are not successful with your demo account.

I always advise new trader to allow their trades to play out instead of rushing to close in profit when they see a little profit or close in red when they see a small red. As a trader, after analyzing the market, set Stop loss and Take Profit level, then allow your trade to reach any of the level, however, you can always move your stop loss into profit to secure some profit incase there is a market structural violation.

If you have any questions, feel free to drop a comment below this article and I will respond accordingly.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

what’s your strategy trading step index

+263772584537

Thank you for the information, I think most of us get into trading as a “get rich quick scheme’, but with this information I think some of us will change our mindset. Be blessed.

How can I know when to enter trade am newbies

Start with Basic that You sell High and You buy Low

When to enter trade in step index have loss a lot am newbies

Merci beaucoup pour l’information, Dieu vous bénisse.

Can I be your student?

Hello 👋 author!

I’m a beginner to trading synthetic indices and I have been searching for different information online on how these financial instruments operate while making some practice on my demo account. I have read that synthetic indices are not affected by fundamentals and their movement is due to random numbers generated by a computer program from a third party. Now my question is, does this mean that big players like banks have no chance to manipulate the price in the market? Does it mean that there is no battle between big players and small players as it occurs in the real forex market? Does it mean it is a battle between a trader (no matter his status) and a computer program? And finally, does the number of buyers versus the sellers have anything to do with determining the next move in the synthetic indices market!

Thank you very much in advance. I’m very curious and waiting for your help!

Synthetic indices respect market structure, which means the forces of demand and supply controls the market not manipulations. There are however some liquidity gap challenges that happen here and now, but I have traded synthetic indices since it started and I can tell you for free that if you understand trendlines, if you can read market structure and interpret candlestick, you will really understand the market.

+923344296674 contact me through whatsapp I will give pull back strategy of step index

Can you view step index on trading view? If yes, then now

Yes, follow this link https://tradingview.binary.com/v1.3.14/binary.html. V25 is the default asset there, you can change to step

Hello warren,do you give signals for step index?from what platforms?I will really appreciate learning while I learn.thank you

Hi am valentine

Am good at trading good and just started boom and crash need funds to start live

I have more than 30 trades lost less than 20 dollar growing a demo account from 500 dollar to more than a 1000 dollar in less than a week trading

Please help me

Promise to be faithful

And i love your article.

+263772532147

Love this bro..

Nice once..

FOREX trading is SELF..

I mean self trade..

Index over my 3yrs trading as self, I’ve a different story wen it’s come to 10 dollar account

Nice very nice sapeech

I am from South Africa

I have started trading about 2 months ago on Forex but lost my funds. I then got a trading Robot for crash 500 to try and make some money but market turned while I was sleeping and account ran out. Now my account is to low to let the robot trade . So now I am trying to do manual trading in order to build up account again and would like to try step Index. Is there anyone who can assist with a good strategy that I can follow with a small account. Only have 20doller account and no more funds left to deposit more.

Would u share ur strategy?

Can you please leave your contact

Maybe telegram or IG so one can follow you

You are highly appreciated