One of the common question I have gotten from many traders is “Which Boom and Crash Strategy is most profitable?” To be frank, the question is simple, but the truth is, most Forex traders don’t want to learn, they are not interested in learning, they just want a quick fix system that can earn them millions of dollars within a month.

Don’t be left out, Learn how to trade forex the right way, Click here to get started

This mindset has given rise to many self-acclaimed Forex gurus who has scammed many; from selling what they call special indicators to Expert Advisors, holy grail strategies, etc., all of which cannot assist you in your trading journey if you don’t have the foundational knowledge of trading. In this article, I am going to share the only Boom and Crash Strategy you will ever need.

Don’t be left out, Open a free trading account now by clicking here

Table of Contents

The Only Boom and Crash Strategy You will Ever Need

What is a Boom and Crash Strategy?

A Boom and Crash Strategy is a set of rules or processes that will guide you on how and when to enter the Forex market, when to exit, the lot size to use and the risk management profile. A strategy without all the items listed above is not good.

A strategy must:

- Define the how (what to look out before placing a trade)

- When to place a trade

- When to exit

- The Lot size to use

- How to manage your risk

Let’s look at the above listed item, one after the other:

What to Look Out for Before placing a Trade on Boom and Crash

The first you should look out for is the market structure.

What is the Market Structure?

Market Structure is sometimes called price action and it’s the general overview of the market. Take for instance, you are going to a real-World market to buy something, if you don’t know where those things are sold in the market, the first thing you will do is to either survey around the market, or you ask questions; whether you ask questions or survey around the market once you get to the section where what you are looking for is sold, you will look for the best shop, then compare prices before making a decision on whether to buy or not.

The Forex market structure is just like that, when you open a Forex Chart, the first thing you should do is:

- Mark the swing highs and swing lows of the market

- Mark supply and demand zones (or support and resistance zones)

- Then draw trendlines

- After that analyse, then decide what to do (buy or sell)

How do you analyse a Forex Market Structure?

Now that you are done with marking and drawing it’s time to do your analyses. This how you analyse:

- First, answer the question of trend (This can easily be solved by your trendlines). For instance, if it’s on an uptrend, according to your trendlines, ask yourself this question, is the price closer to the higher high? Is the price closer to a resistance zone? (If the two questions are yes, then a reversal MAYBE imminent), the reversal can be a short term pull back or a complete reversal. In this kind of scenario, if you are selling wait and see the reaction of the price at the resistance zone before you place a sell

- For a buy, ask yourself this question is the price closer to the lower low? is the price approaching a support? if the answer to the above question is yes, then a buy opportunity MAYBE imminent (It can be a long term buy or a short term buy. In this kind of scenario to buy, wait for price to reach a proven support or break a trendline based on your drawing and marking.

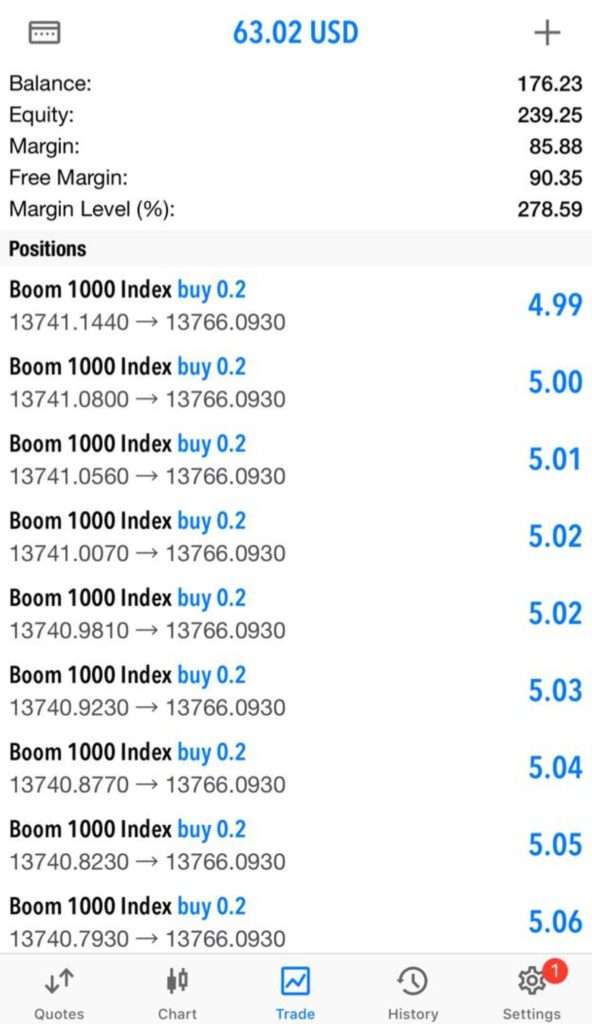

- Secondly, answer the question of the asset. The problem I see most trader face is the question of Asset, you can’t trade V75 the same way you are trading Crash 500, no, it doesn’t work that way. During your analysis make sure you look at the asset critically so that you can decide your lot size based on the asset and your equity. If you were trading Crash 500 for instance, then you suddenly switch to V75, your 0.20 lot size for Crash 500 will still be there which can either mar or make your account if you take a trade on V75 without remembering to adjust the lot size.

- There are other things to look out for but let me stop at just trend and Asset.

When to place a trade on Boom and Crash

After your analyses, the next step is placing a trade, because if you are a trader and you don’t place a trade, you won’t make any profit. So how do you know when to place a trade on Boom and Crash? Knowing when to place a trade on Boom and Crash is what makes the different between the reds and the blues in your trading history.

Let me establish some ground rule:

If you are Selling say Crash 500 and you want a 99.9% probability of a win. Based on your analyses you need to wait for it to:

- Approach a resistance zone

- Approach the Higher High or

- Break your trendline to the downside

If it approaches a strong resistance zone based on your markings there is a great chance of you winning the trade, but other factors you should consider too is the trend, because it might just give a small crash then continue the uptrend, if it’s a reversal or a short pull back, it may give a small crash, then a series of continuous long crash. The same rule applies when it breaks the trendline.

N/B: My advice to newbies and struggling Crash and Boom traders is, learn how to sell crash and buy boom, because you can easily control the draw-down. For instance, if you are selling Crash 500 near a strong resistance zone, you can put your Stop loss few pips above the resistance zone so that if it breaks up, you will lose small money and monitor the spikes to adjust your Stop loss to the profit side once it spikes or close after the spikes if it’s an uptrend.

You can also Buy Crash and Sell Boom: For Crash buy, it’s important that you buy in a strong support and have a Stop Loss few pips below the support. If I’m buying Crash (which is rare), I follow the ‘M’ pattern, once I see a formation of the M, I jump in at one of the leg and take my profit few pips before the next resistance. Same thing with selling Boom, wait for the ‘W’ formation, sell at one of the legs from the top and close before it get’s to the nearest support.

The key thing as a trader is to set some conditions that will enable you to enter a trade and stick to those conditions.

How to Mange your Risk

If you don’t know how to manage risk, you will not be a successful Forex trader. Knowing how to manage risk entails knowing when to exit a trade, lot size to use and stopping when you meet your daily profit/loss margin.

As a rule of thumb:

- Never lose more than 10% of your equity in a single trade (that is while you have stop loss)

- Your lot size matters, especially based on your equity and capital. So grow your account bit by bit, don’t aim to hit it big with just one stupid big lot

- If you have a bad trading day, close and look at your trading history, understand while you lose the trades before you return back to the market

Risk Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.