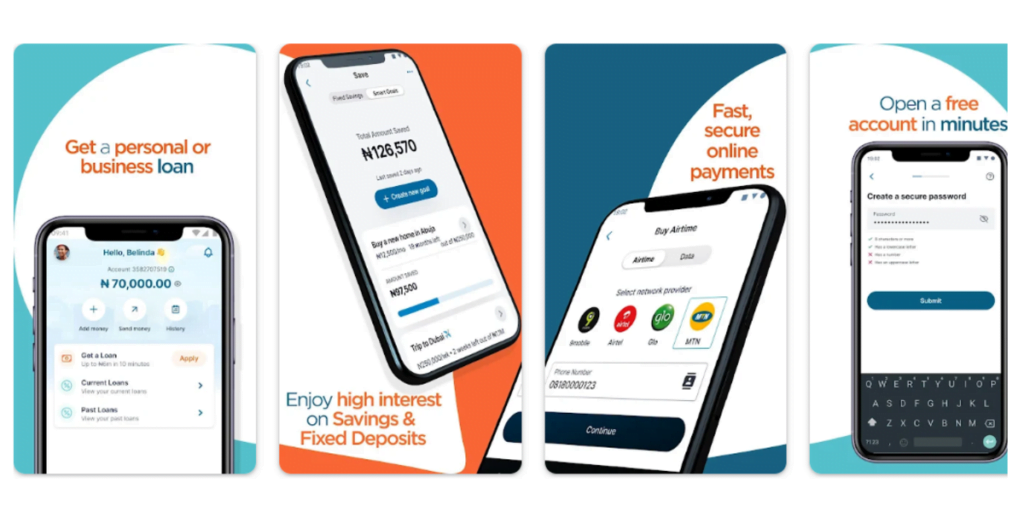

Renmoney is a Nigerian fintech lending microfinance bank that began its operations in 2012. Notorious amongst salary earners and small business owners for providing convenient and personal and business loans to cover a variety of needs,.

This article aims to share information about Renmoney, how you can get a loan and investment option.

Table of Contents

What is Renmoney?

Established in 2012 as Ren Credit, Renmoney is a Nigerian financial service institution that was set up by a group of fintech experts intending to directly solve the financial needs of Nigerians through innovation, technology, and knowledge.

Located in Lagos, Nigeria, Its headquarters is at 23 Awolowo road, Ikoyi, Lagos and other branches in Ikeja, Marina, Lekki and Surulere.

Loan Requirements

Renmoney has certain loan criteria that individuals who intend to get a loan must meet before they are given a loan.

These Include:

- Individuals intending to get a loan must be within 22-59 years

- They must have an active savings or current bank account with a Nigerian financial institution

- Individuals must have a source of income with a valid identification image of the company they work for.

- Must have a clean credit history of no default made on loan payments.

- Must provide at least 6-months statement of their bank account and proof of utility bill recently paid.

- Loan applicants must have a recent passport photograph and a valid Nigerian identity card.

Loan amounts and Interest rates

Their loan offers ranges from 50,000 – 6,000,000 naira with a 3-24 months loan repayment periods. The amount is dependent on an individual income while their interest rate is dependent on the loan amount and the repayment tenure chosen by an individual. However, there is a maximum annual interest rate of 35.76% with no extra fees added or hidden fees.

Still, if you default on repaying your loan at its due date you will be charged a default fee of 300 naira per day(this works for the seven days that make up a week) and you will be barred from collecting any loan from any other financial platform or institution.

How you get a Renmoney Loan

- Getting a loan is easy and fast as Renmoney works to provide loans within 24 hours of application. To get a loan you can download the app from the Google play store or visit www.renmoney.com to apply.

- After the app download, proceed to install the app and register by providing the necessary details required in the form you will be presented with.

- Log in to the app or website after a successful registration, and apply for a loan.

- When applying for a loan, upload the required documents and choose a loan amount as well as a repayment tenure.

- Renmoney loan calculator will display the interest rate the loan amount you choose will incur as well as the amount you will be required to repay every month.

- Submit your loan application. Once your loan application has been approved and you will be credited to your bank account within 24 hours.

How to repay your Loan

- To repay your loan, you can walk into the Renmoney branches or head office and repay over the counter or repay through the use of Quickteller

How can I get the best Loan offer?

- Renmoney offers loan amounts ranging from 50,000 – 6,000,000 naira. This loan amount can improve with a good credit history which includes prompt repayment when due.

- But, how can you get the best loan offers? This is a commonly asked question.

- To access the best loan offers, loan applicants must pay attention to the loan information they provide.

- As a loan applicant, you must understand that your credit profile and your daily, weekly and monthly cash flow will play an important role in Renmoney’s decision to offer you a loan. You must be careful about the information you provide with regards to this.

- Select the right repayment tenure and loan amount.

- Sometimes Renmoney rejects loan applications and this is due to the kind of details a loan applicant provides

- When deciding on how much to borrow, endeavor to choose an amount within your debt-income ratio if you don’t want your loan application to be rejected. Also, choose a flexible loan duration you can comfortably repay when due.

About Renmoney Investments options

- Renmoney investments are one of the ways Renmoney allows its customers to earn money.

- Its investment option is divided into Renmoney Savings and Renmoney Deposits

- Renmoney Savings which is further divided into the SaveEasy plan and SmartGoal plan allows one to save smartly and at convenience while also earning interest relevant(8-10% per annum) to the amount saved. The Smartgoal plan allows one to save towards the actualisation of a goal and still earn interest.

- Renmoney Deposits works as a fixed account for a chosen time frame. It also has an interest of about 5% per an um attached.

Visit www.renmoney.com to learn more about Renmoney.