Fully developed by Nigerian Fintech company – SystemSpecs, Remita is one of Africa’s leading payment platforms.

In this article, we will look at everything you need to know about Remita; including how you can complete your Remita registration and how to retrieve a lost Remita payment invoice.

Table of Contents

What is Remita?

Remita is a payment service that was launched in 2005 by the Fintech company-Systemspecs which was founded by renowned software expert- John Obaro.

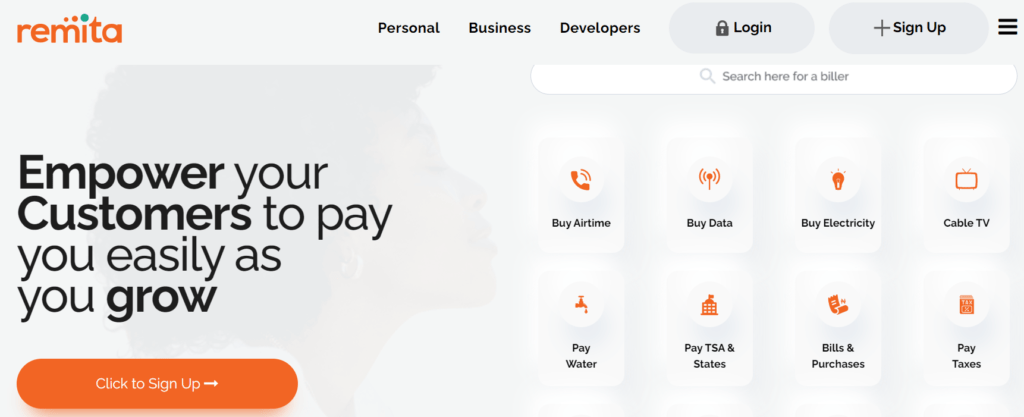

It offers electronic payment solutions that enable its users to pay a wide range of bills including utility, cable, salaries, education(school fees) and even make purchases both locally and internationally.

Benefits

- This payment service plays a significant role in the day-to-day operations of businesses and organizations. It provides an easy way to pay bills and manage finances with the use of its management options.

- Allows its users to conveniently pull payments from several sources to their local(home) bank account.

- Has zero activation fee plus it is fast, reliable and secure to use. Did you know that FGN uses the platform to process payments for its TSA (Treasury Single Account)? That is proof of how safe Remita is.

How the Remita process works

- Remita makes use of about 9 payment channels to ensure a payment need has been met at zero activation fee.

- Payment channels include: Terminals, Point of Sales, Mobile wallets, direct debit, debit/credit cards, Remita mobile app, its recognized website and more.

How to Open a Remita account

- To register on Remita, you would have to download the Mobile app from your Smartphone’s Google App store or the APP store or visit www.remita.net to sign up.

- The mobile app allows users to send money, pay bills, manage orders, request money(loans), manage several bank accounts, generate receipts and even buy data and airtime.

- After a successful download of the mobile application, click on “sign up. Complete the form displayed on the next page with accurate details.

- You will receive an email with login instructions to the Email address you filled in earlier on the registration page.

- You can print out the registration form and proceed to activate your account.

- To activate your account, you will have to sign the registration form you printed earlier and take it to a physical banking institution recognised by Remita. At the bank, you would be given an automatic code which will be inputted to your Remita account.

- Now, log in to your account using the login instructions you were given on the email that was sent to you by Remita and change your password from the automatic code given to you by the bank to activate your account.

- After activating your account, proceed to complete your profile with the basic details required.

How to pay bills with RRR code

- Bills payment on Remita is relatively easy. To pay bills on Remita, log in to the app or website, and navigate to ” Pay a biller”.

- You will be given a dropdown menu of 3 categories to choose from(Pay once, recurring payment and pay E-invoice).

- Select your biller and fill in the form you will be provided with. Then Submit.

- You would be redirected to the next page which holds an RRR code(Remita Retrieval reference code ) for your transaction. Copy the RRR code.

- You have successfully generated your RRR code, now click on the “E-invoice “tab on the “pay billers” page. Enter the code and choose your preferred payment channel( Debit/ credit card, Mobile wallets, direct debit and more)

Please note: The RRR code is Remita’s way of retaining information on a transaction, it can be referred to later by a user when in need of details of a transaction. The RRR code is not reusable although it does not expire. You can generate an RRR code on the Pay billers page or the biller can generate the code for you.

How to retrieve a lost Remita Payment Receipt

- This is when the primary function of Remita’s (RRR) code is used. Retrieving your payment receipt is easy with the use of an RRR code.

- Click on “Resend Receipt or invoice” tab, and enter the RRR code that was used earlier to pay for the transaction you wish to retrieve.

- Now, click on “Resend Receipt”. A receipt of the transaction will be sent to you via the Email address you used to register or listed in your account

About Remita Loans

- The payment service also provides loans to its customers. Their loans are flexible with a convenient repayment period, and zero fee charges asides from its interest rates which is only 3.76% of a loan amount per month.

- Remita loans partners with 3 primary loan platforms( Paylater, Payday, and Page financials) to make a loan credit possible.

- Remita Payday loans allow a loan applicant to borrow a certain percentage of his actual earnings in advance. The loan will later be deducted as soon as the loan recipient receives salary.

- Remita Paylater loan works in the same way as the Payday loans the difference is that to be eligible for a loan, an applicant must present a proof of income.

- The Page Financials loan which is often up to 5 million, is offered to recognized staff of reputable organisations, and companies. Loan applicants are required to have a stable and reliable source of income to access this loan option.