From volatility indices to range break indices, daily reset indices, Jump Indices, Step Indices and Crash and boom indices, here is everything you need to know about trading synthetic indices on Deriv.

Don’t be left out, Learn how to trade forex the right way, Click here to get started

There is no week that goes by that I don’t read about these indices. Either as a comment on a post I made; a conversation between friends or a follow up questions from a seminar I facilitated. Seen by many as the real deal in Forex trading, synthetics indices popularity has continue to grow everyday.

Table of Contents

So What is synthetic indices

According to Deriv experts, synthetic indices are indices that are engineered to simulate the real world market and movement; in order word, they are programmed to simulate real World market and movement and are based on a cryptographically secure random generator that is regularly audited by an independent third party to ensure fairness.

They have constant volatility (Volatility here refers to the degree of variation of price over time); they are free of market and liquidity risk and are unaffected by natural events.

Types of Synthetic indices available on Deriv platform

They are 6 of this indices available on Deriv platform; and they include: Volatility indices, Crash and Boom indices, Step indices, range break indices, daily reset indices and jump indices.

Volatility indices

Volatility indices are indices that correspond to simulated markets with constant volatilities of 10 percent, 25 percent, 50 percent, 75 percent and 100 percent. The Volatility indices are divided into two; One second volatility indices and two second volatility indices

In one second volatility; one tick is generated every second, one second volatility indices include:

Volatility 10(1s) index, Volatility 25 (1s) index, Volatility 50 (1s) index, volatility 75 (1s) index and Volatility 100 (1s) index.

In two second volatility indices; One tick is generated every 2 seconds. Two seconds volatility indices includes Volatility 10 index, Volatility 25 index, Volatility 50 index, Volatility 75 index, and Volatilty 100 index.

Crash and Boom indices.

In Crash and Boom only 4 options are available; Boom 1000 index, boom 500 index , crash 1000 index and crash 500 index. The Crash and Boom indices have an average one drop (crash) or one spike (boom) in prices that occur in a series of 1000 or 500 ticks

Step Indices.

The Step indices are indices that has an equal probability of an upward or downward movement in price series with a fixed step size of 0.1 and a contract size of 10

Range Break Indices

Range break indices are indices that fluctuate between two price points or borders; they occasionally breaks through the border to create a new range. This usually happens on average once every 100 or 200 times price hit the borders

Daily Reset Indices

Daily reset indices are indices that replicate markets with bullish and bearish trends with constant volatility. The bull and bear market index are often reset at 12 midnight GMT daily.

Jump Indices

Jump indices are indices that corresponds to simulated markets with constant volatility of 10 percent, 25 percent, 50 percent, 75 percent and 100 percent.

Advantage of trading these indices on Deriv

They are so many advantages of trading these indices in Deriv. Some of them include:

1. There is high leverage and tight spread which allows you to maximize market exposure and potential profit while smartly managing your potential loses.

2. Low capital: You don’t need a large chunk of money to start trading on Deriv. No matter your pocket, there is a lot of opportunities for you

3. you can trade these indices on Deriv 24/7.

How to trade synthetic indices

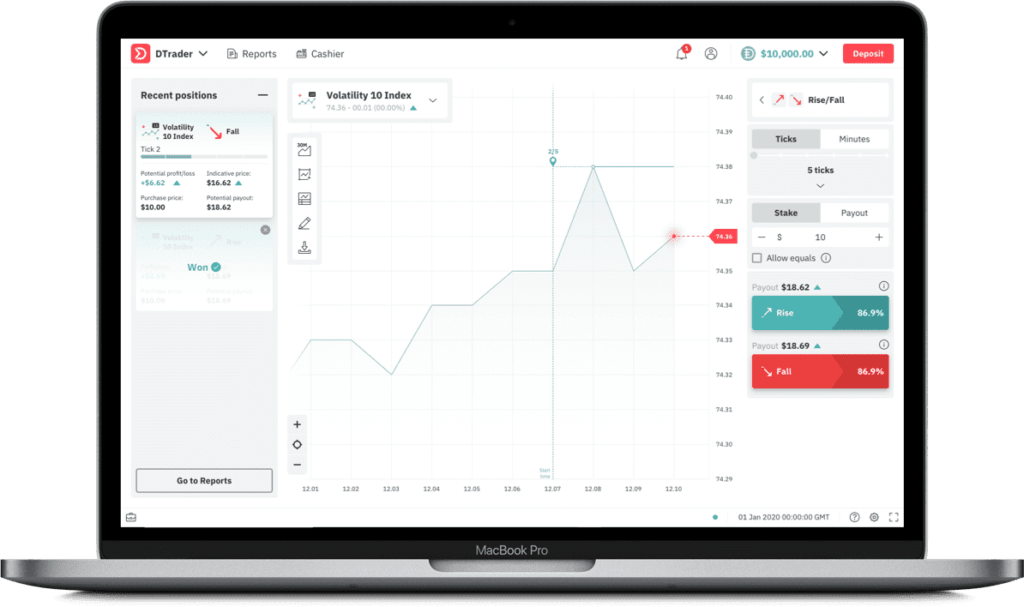

You can trade these indices on Deriv mt5, DerivX, Dtrader, DerivGo, e.tc., It’s important that you start a free account on Demo and start practising your strategy first before opening a real account.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.