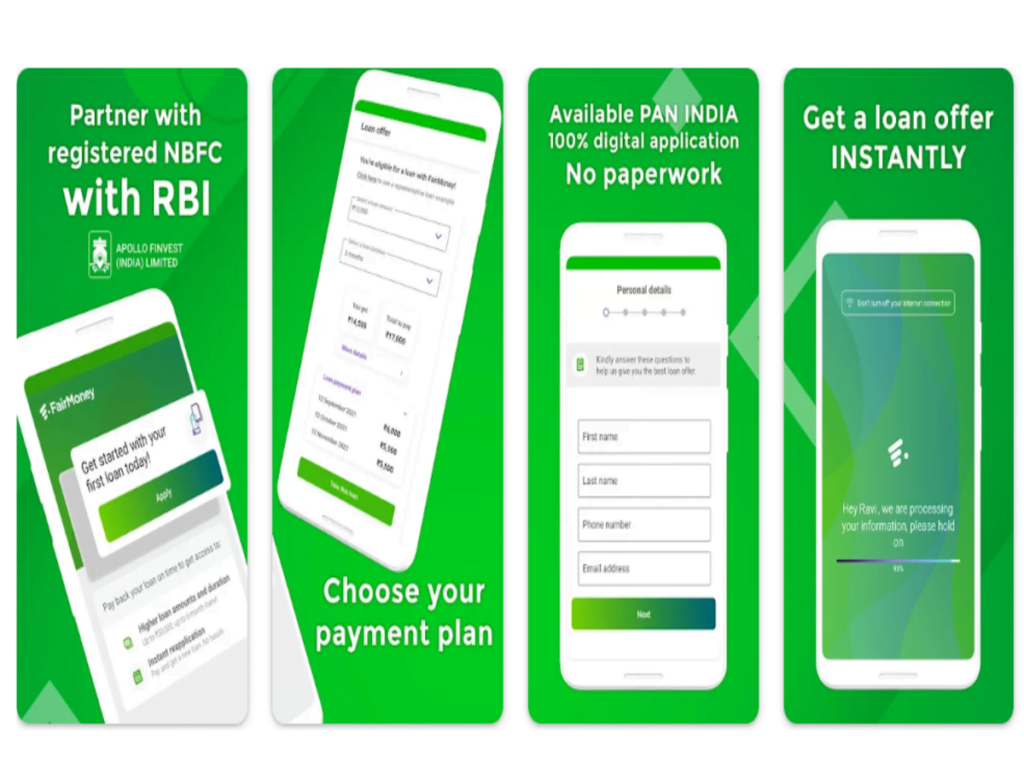

Fairmoney is a leading digital microfinance bank that specializes in giving credit and debit services to thousands of individuals at a flexible rate.

Launched in 2018 and headquartered in Europe, the app has over the years developed into a fast and reliable go-to app for lending purposes. They offers loans up to 1 million naira for an 18months repayment tenure with no collateral, guarantor or tons of paperwork required.

This article will guide you on how to get a loan with Fairmoney, explain its interest rates, repayment terms and more.

Table of Contents

Why use Fairmoney?

- The app is flexible, secured, assured, fast and free.

- The app can be accessed anywhere and at any time as long as you are a registered user and you have an internet connection on your mobile device.

- It has no loan requirements besides registering. There are no collateral required, guarantor needed, no hidden processing fees, unlike some financial services platform.

- The credit amount you can get with the is not limited. New customers on the app can get loans ranging from 10,000 to 40,000. This can improve with a good credit history. As a new user, you can receive 0% interest on 1st 15-day loan.

- With the app you can pay your utility bills(buy airtime, cable, electricity) at any time you want and even get a 3% cash back for every bill payment made.

- They offers free and secure debit cards to users with free delivery wherever you are

- The app is one of the few Fintech platforms that offers 100 transfers monthly to any bank you choose without charging a fee.

- They offers 2.1% returns on every investment made on the app.

- Fairmoney’s unique Fairsave allows you to earn 10% annual interest rates for every amount you save in your Fairsave account.

- With the app, you can repay your loan before the due date, you can even extend your loan repayment duration if you are unable to repay your loan at its due date.

- They offers lots of benefits with no cons attached, no wonder it has become a popular fintech service to users over the years.

Getting started

- Download the app from your Android’s Google play store

- Install the app and click on “Sign up ” to begin registration.

- Select your country and enter a valid phone number( I would advise you signup with a phone number linked to your BVN to make it easier). You will receive a verification message to the phone number. Verify and continue.

- Create your 4-digit pin and make sure it is safe and secured, and proceed to log in.

How to apply for a Fairmoney loan

- After you have successfully verified your phone number, you will be redirected to the app’s dashboard.

- On the dashboard click “Get a loan”, you will be redirected to the loan page

- On the loan page, you will be required to provide some basic details, valid bank details, BVN, ATM card details to enable auto-debit when repayment is due, a photo taken in real-time, and even permission to access your device SMS, location and phonebook. Don’t worry, this are just steps taken by app to set up your account.

- Fairmoney will give you their lending decision with regards to your loan request within a few seconds.

- If you get a positive reply, you can proceed to accept the loan. Select the repayment term you are comfortable with( 15 days, 30 days with suiting interesting rates).

- Congratulations, within a few minutes you will receive your approved loan money in your fairmoney wallet. You can proceed to withdraw.

- Sometimes, your loan request could get rejected by Fairmoney but this occurs in rare cases. If a loan request gets rejected, don’t worry, you can reapply to get a loan in 15 days.

How to send money on the app

- To send money, click the “Send Money” icon on the top left corner of the dashboard.

- Input the amount you want to send, and tap “Continue”.

- Enter the account number you want to send money to and choose the bank. You can fill in your purpose of sending the money(optional).

- You will be required to enter your 4-digit pin to authorize the transaction. Input the pin and proceed to send. The money will be sent successfully to your intended recipient.

How to fund your Fairmoney account

- Funding your account Is easy. Tap on ” Fund Account” on the dashboard.

- You will be redirected to the next page where you will be presented with funding options( bank transfer or USSD).

- Tap on your preferred mode of funding and proceed to fund your account.

Interest rates and repayment terms

- The app operates fair and transparent interest rates.They charges about 10-30% monthly depending on the loan amount and loan term you choose.

- Its repayment terms are flexible too.theyoffers a loan repayment tenure of 15 days – 24 weeks. Whichever loan tenure you choose is entirely your decision but it should be one you will find convenient.

How to repay your loan

- Simply click “Repay loan” to repay your loan. You will be required to choose a payment mode(from the bank and card details) you had earlier set up during your loan application.

- You can choose the debit card option, or the USSD option to repay your loan.

To learn more about Fairmoney, visit; fairmoney.ng